Unified PropTechUSA.ai Net Offer Sheet

How our indices come together into a single, seller-facing offer with transparent line-items and guardrails.

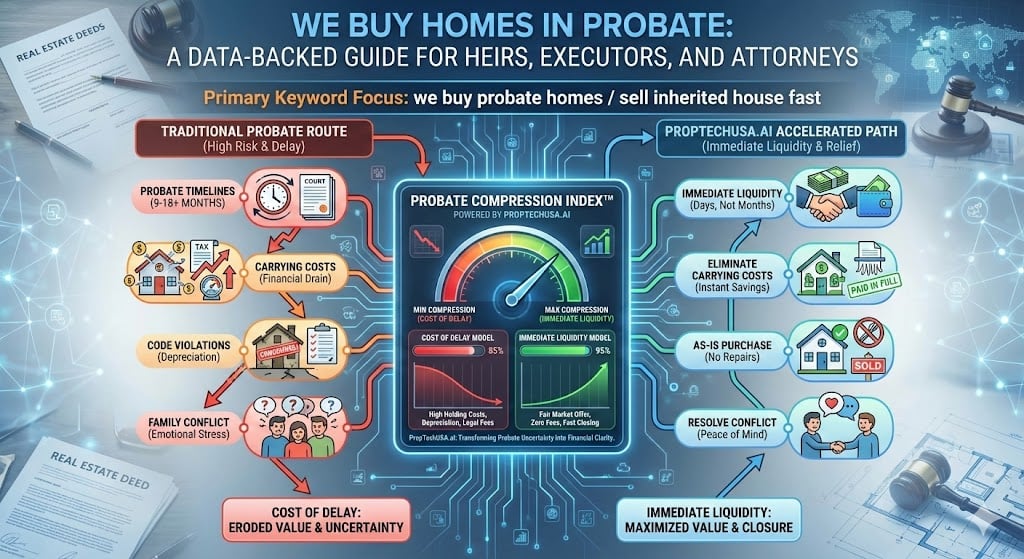

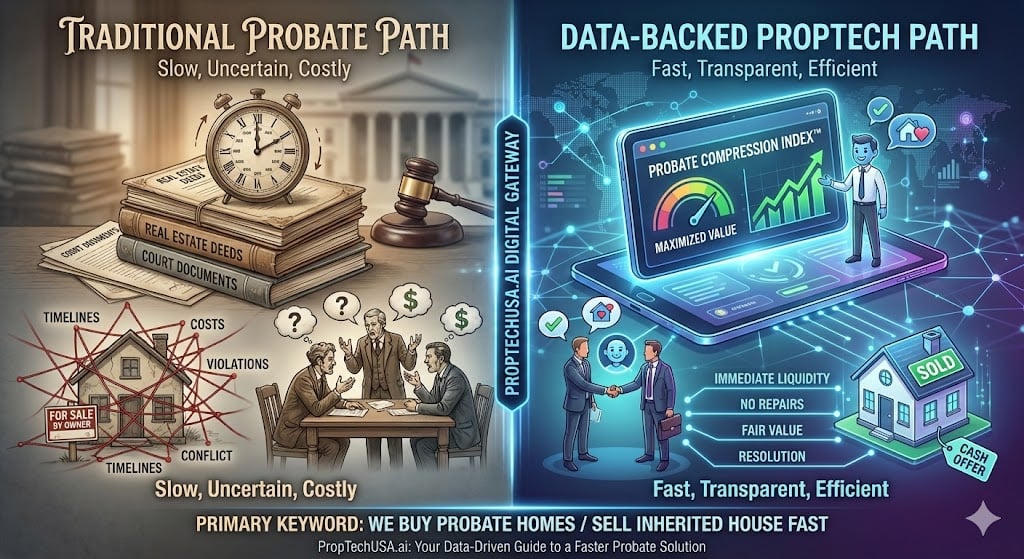

Probate was supposed to settle things. Instead, you’re juggling court deadlines, family expectations, mounting bills, and a house that may not be safe or up to code. This guide shows how we buy probate homes nationwide, how to sell an inherited house fast without tripping over legal landmines, and how our Probate Compression Index quantifies the cost of delay versus immediate liquidity.

A traditional sale has two timelines: prep + list, then contract + closing. A probate sale layers a third timeline on top: the court calendar. That extra axis is where most stress and confusion lives.

Executors are asked to maintain the property, respond to neighbors, and keep insurance in place while also waiting for letters testamentary, notices to heirs, and court approvals. The market doesn’t stop moving while everyone waits.

One sibling is cleaning the fridge and mowing the lawn. Another lives out of state and only sees list prices online. That mismatch in effort and visibility is a recipe for “We’re leaving money on the table” arguments—especially if the house needs work.

Our research at PropTechUSA.ai—combined with nationwide seller sentiment from the HSS/API Home Sale Sentiment models —shows the same pattern across states: probate sellers underestimate the cost of waiting and over-estimate what retail buyers will pay for an outdated, vacant home with estate paperwork attached.

Every extra month an inherited house sits during probate quietly erodes the estate’s net. Taxes, insurance, utilities, yard care, security, and basic maintenance aren’t optional—especially if the home is vacant.

In many probate files we review, the estate is spending $120–$220 per day in true carrying costs. Over six months, that can erase $20,000–$40,000 of value before a single repair is made.

Vacant homes attract leaks, pests, and city inspectors. A simple roof leak or notice of violation can turn into a five-figure problem if nobody is on site. Many heirs don’t learn about the issue until it reaches the closing table.

While the court moves at its pace, rates and buyer demand shift. Our Interest-Rate Lag research shows how quickly certain price points lose buyers when financing costs jump.

The Probate Compression Index (PCI) is a PropTechUSA.ai framework we use internally when we buy probate homes. It doesn’t replace legal advice, but it gives heirs, executors, and attorneys a clear, numeric view of the trade-offs they’re debating.

For each estate, we model two paths:

The PCI score tells you how many dollars of expected value you are giving up (or gaining) per month by waiting. When that curve goes negative, “sell inherited house fast” stops being an emotional decision and becomes a strictly rational one.

Use this simple model to compare Path A: sell now to a vetted cash buyer versus Path B: hold, repair, and list. Adjust the numbers to match your estate—then send the snapshot to our team with one click when you’re ready.

Every family and estate is different, but certain patterns show up again and again in our data. These are scenarios where selling quickly to a direct cash buyer like Local Home Buyers USA often leaves the estate better off—even if the headline price is lower than a dream list number.

The home needs roof, HVAC, or structural work that nobody wants to fund. PCI usually shows the estate loses more by waiting and borrowing than by accepting a solid as-is offer now.

When nobody lives nearby, travel and coordination costs spike. Vacant-home risk also increases. The compression effect of distance often makes immediate liquidity mathematically superior.

Expensive markets with slow probate courts are the textbook case for PCI. If you’re burning $200/day and staring at 9–12 months of process, delay can erase six figures before list day.

None of these scenarios require panic. They simply benefit from having a written, no-obligation cash offer from a buyer that understands probate logistics and can coordinate with your attorney and title company in any state.

Local Home Buyers USA isn’t just another “we buy probate homes” postcard. We pair local title partners and attorney-friendly contracts with PropTechUSA.ai research so your decision is grounded in data.

Because we buy in all 50 states, we can support multi-state estates and families with heirs in different time zones—without restarting the conversation every time a file crosses a state line.

Probate sales attract good buyers and bad actors. Deed fraud, wire fraud, and wholesaler misrepresentation all spike when stressed heirs are dealing with unfamiliar paperwork. Our closing teams treat seller safety as part of the service.

Whether you sell to us or someone else, treat the estate’s equity like any other asset: protect the paperwork, verify every step, and don’t move money until the professionals on your file confirm it’s safe.

In many states you can sign a purchase agreement while the estate is in probate, as long as the right person signs (executor, personal representative, or administrator) and the court or attorney approves the sale. We’ll coordinate timing with your legal team so the contract and closing line up with your state’s rules.

Once the estate has authority to sell, Local Home Buyers USA can typically close in days or on your chosen date. The court timeline may be fixed, but your closing timeline doesn’t have to drag on once the green light is given.

In most probate closings, those items are paid from the sale proceeds at closing. When we buy probate homes, our team and the title company pull payoff statements, municipal liens, and code items so they can be handled on the closing statement without heirs writing separate checks.

Yes. We buy probate and inherited houses nationwide—urban, suburban, and rural. We partner with local title/escrow or attorneys and adapt our paperwork to your state’s requirements, whether you’re handling an independent administration or more court-supervised process.

Start with your likely list price, then subtract realistic repairs, commissions, concessions, and 3–9 months of carrying costs. Compare that net to a written cash offer from us. Our Probate Compression Index and offer comparison guide make that math straightforward.

If you’re handling an estate, you don’t need another high-pressure sales pitch—you need clarity. Share a few details below and our team will review the property, run it through our Probate Compression Index models, and follow up with a straightforward, written cash offer. No commitments, no obligation to accept.

Explore the indices and pricing rails powering Local Home Buyers USA. We don’t guess. We model — then expose the math for sellers, partners, and regulators.

How our indices come together into a single, seller-facing offer with transparent line-items and guardrails.

Measures local absorption and buyer intensity to inform timelines and pricing power.

Quantifies the value unlocked by a Novation partnership relative to an as-is cash sale.

Estimates real-world hurdles to closing (ID, title, occupancy) and shows how tasks lower risk.

Composite execution-risk score that drives the transparent Certainty Adjustment in every offer.

Signals clarity of comps, HOA disclosures, and public data—improving expectations and timelines.

Macro-local health: employment, permits, inflation, delinquencies—expressed as a stability score.

Implementation notes and lead-gen calculator patterns for deploying FOS in production.

Models expected value from targeted repairs vs timeline risk under Novation or cash.

How time-to-close and execution risk translate into a fair, transparent adjustment.

Captures block-level sentiment and uncertainty that drive list-to-close variance.

Datasets, sources, and licensing (CC BY 4.0) for transparency and reproducibility.