PropTechUSA.ai | Seller Stress Dashboard

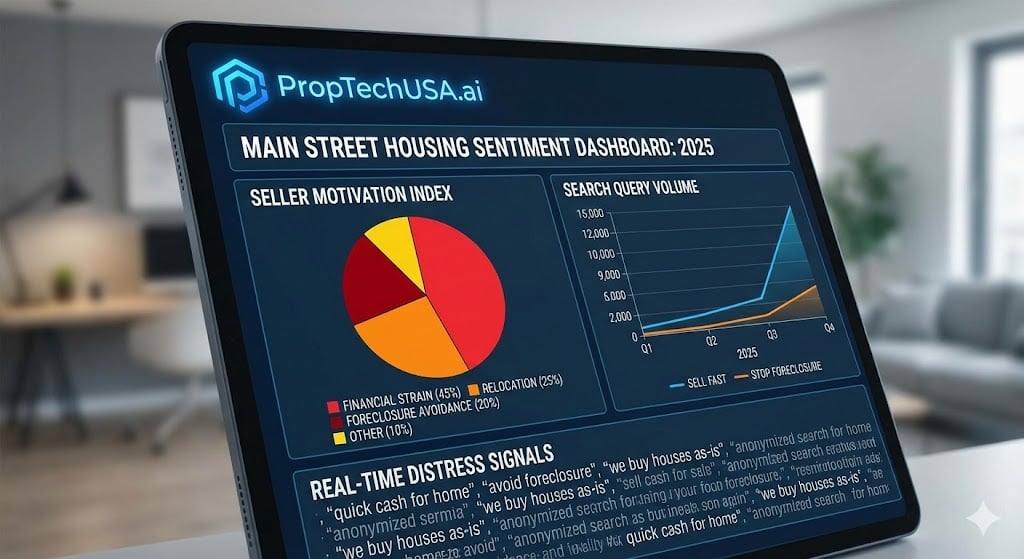

Search Sentiment & Seller Psychology: What 10 Million “Sell My House Fast” Searches Reveal About 2025

Forget lagging housing reports. The real-time stress of American homeowners shows up first in how they search: “sell my house fast,” “we buy houses,” “stop foreclosure,” and dozens of variations typed in at 11:47 p.m. on a Tuesday.

- See how search spikes map to affordability shocks, landlord fatigue, and pre-foreclosure distress.

- Understand what your own “sell fast” searches reveal about your situation.

- Learn how Local Home Buyers USA, powered by PropTechUSA.ai, turns sentiment into real options for Main Street sellers.

Interactive · Live Seller Psychology Console

Seller Sentiment Console 2025

Slide the dials and tap the tags that match your situation. The console will translate your private “sell fast” search energy into a clear psychology zone and a next-step game plan.

Step 1 · Tag what’s driving your search

Most “sell my house fast” journeys start with a mix of time pressure, money stress, property condition, and life complexity. Start by tagging the forces that feel strongest right now.

Step 2 · Tune the dials

Live sentiment readout

Updated instantly as you adjust tags and sliders. No email, no form—just a mirror for where you really are.

Right now, your mix of time pressure, monthly math, and property friction looks a lot like a deadline-leaning, net-conscious seller. You’re not just chasing price—you’re trying to protect your next chapter.

- Map your real deadline on a calendar and circle it in pen—this becomes the anchor for every decision.

- List your true monthly “stress cost”: mortgage or taxes, insurance, utilities, HOA, and the next big repair.

- Compare a realistic listing timeline against a guaranteed cash-by-X-date option so you see the trade in plain numbers.

Why the Google Search Bar Is 2025’s Real-Time Housing Stress Index

Surveys are polite. Search histories are honest.

If you want to understand how stressed American homeowners are in 2025, you don’t start with glossy market reports. You start with the quiet, private, sometimes desperate phrases typed into a search box: “sell my house fast,” “we buy houses,” “stop foreclosure now,” “sell rental with tenants,” “cash offer no repairs.”

At PropTechUSA.ai—the research engine behind Local Home Buyers USA—we treat this search exhaust as a real-time sentiment feed for Main Street housing. We don’t need to know who typed what. We just need to understand where those phrases spike, when they spike, and what else is happening in those markets: insurance shocks, property tax jumps, stalled rent growth, or a looming affordability wall.

Search Sentiment, in Plain English

When a ZIP code suddenly starts searching “sell my house fast” more than usual, it’s often the first visible crack in the story: long before a foreclosure filing, a price cut, or a wave of new listings show up in the official data.

In this flagship report, we’ll deconstruct the psychology behind those searches, map them to affordability tipping points , stalled rent growth , and pre-foreclosure risk, and then show you how to turn that late-night search into a calm, numbers-first plan.

What You’ll Learn in This Report

- Why “sell my house fast” is a time-pressure signal, not just a keyword.

- The three distress query families and what they reveal about real sellers.

- How spikes in search sentiment line up with the 2026 Affordability Tipping Point and landlord exit pressure.

- The four seller archetypes hiding behind search histories (and which one you might be).

- How PropTechUSA.ai turns anonymous search trends into a seller-first strategy engine.

- A practical playbook if you just caught yourself searching “sell my house fast” or “stop foreclosure.”

The Three Distress Query Families (And the Psychology Behind Each)

Every “sell fast” search has an emotion attached to it.

1. “Sell My House Fast” — Time Anxiety

This phrase rarely comes from a relaxed, spreadsheet-driven seller. It usually comes from someone who feels the clock is louder than the comps.

- Relocation deadline or new job start.

- Upcoming divorce, health event, or aging-parent care move.

- Carrying two homes at once and bleeding cash each month.

Translation: they’re willing to trade some upside for certainty and speed.

2. “We Buy Houses” — Friction Fatigue

“We buy houses” is less about emergency and more about avoiding hassle. These sellers are allergic to:

- Repairs, showings, and open houses.

- Strangers judging their home’s condition.

- Deals falling apart over inspection fights and financing.

They don’t want to be project managers. They want a clean, quiet exit.

3. “Stop Foreclosure” — Survival Mode

“Stop foreclosure,” “sell house in pre-foreclosure,” and “how long before bank takes my house” show up when the seller is past discomfort and into fear.

- Preserving credit and future borrow power.

- Avoiding public auctions and sheriff sales.

- Trying to protect remaining equity before the bank eats it.

If this is you, study Pre-Foreclosure Chess: Keep Your Equity or Lose It before you make another move.

The Seller Sentiment Radar: Where Do Your Searches Fit?

Plot yourself before you price yourself.

Most “sell fast” searchers fall into one of four psychology zones. Knowing your zone helps you avoid making a fear-based decision when a calculated one is possible.

| Sentiment Zone | Typical Searches | What You’re Really Saying | Best Next Step |

|---|---|---|---|

| Deadline Pressure | “sell before job move,” “close in 30 days” | “My timeline matters more than squeezing every last dollar.” | Quantify deadline costs vs. discount; compare cash vs. fast MLS listing. |

| Friction Avoidance | “we buy houses near me,” “sell as-is no repairs” | “I’m willing to trade some equity to skip the circus.” | Get side-by-side net sheets for “clean as-is offer” vs. “fully marketed listing.” |

| Financial Strain | “can’t afford mortgage,” “behind on payments” | “Holding this home is hurting my monthly life.” | Combine a realistic budget, hardship options, and fast-sale scenarios before you default. |

| Distress / Pre-Foreclosure | “stop foreclosure,” “how long before auction” | “I’m trying not to lose everything.” | Map your exact legal timeline and explore as-is cash sale vs. loan workout immediately. |

Interactive: Which Seller Story Sounds Most Like You?

Click a card and we’ll translate your searches into a clear next step.

Start with the one that feels closest. You can always click around—most sellers have a mix of these.

Not sure? Think about what you’ve actually typed into the search bar in the last 30 days.

Deadline Seller

You’re racing a calendar, not just the market.

- You’ve searched things like “sell my house fast before job move” or “close in 30 days.”

- Your biggest fear is missing a move, school year, or court date—not wringing out every dollar.

- You’re open to trading a little upside for a closing date you can circle in pen.

Recommended next step: write down your hard deadline, then request a data-backed cash offer from Local Home Buyers USA and compare it to a fast MLS listing. Put both on the same net timeline so the best path is obvious.

Micro-App: Which Exit Path Is Best for You?

Four quick questions. One clear recommendation: fast as-is cash, traditional listing, hold & stabilize, or landlord exit.

Help us localize your result. This stays anonymous, but lets us tailor your recommendation to your state and ZIP code.

1. What’s stressing you most about this property right now?

2. How much time do you realistically have before this becomes a crisis?

3. Be honest: how much work are you willing to do on the property?

4. What’s your real goal for the next 12–24 months?

What 2025 Search Spikes Reveal About the Macro Market

Search sentiment is the smoke. Affordability and cash flow are the fire.

1. Affordability Breakpoints Are Showing Up First in Search

In our 2026 Affordability Tipping Point by State analysis, we map where mortgage payments, insurance, and taxes have outrun local incomes. In those same states, we see a disproportionate rise in:

- “sell my house fast” + “[state name]” searches.

- “move out of [state]” + “can’t afford house anymore.”

- “cash offer for house” shoulders up against “insurance too expensive.”

The conclusion is simple but powerful: when the monthly math stops working, homeowners reach for speed, certainty, and exit options—and they reach for them online first.

2. Tired Landlords Are Quietly Typing Their Way Toward the Exit

Another clear pattern in 2025 search sentiment: the “over-it landlord.” In markets where rent growth has cooled but costs haven’t, search volume climbs for:

- “sell rental with tenants,” “landlord wants to sell house.”

- “tired landlord options,” “landlord exit strategy.”

- Paired queries: “tenant behind on rent” + “we buy rental properties.”

For this group, we combine macro analysis from Rent Growth Stall 2025: Cap Rates & Exit Options with individualized math via the Landlord Exit Calculator 2026 . The goal: turn that swirling “maybe I should just sell” search into a clean, modeled decision.

3. Insurance, Taxes, and “Soft Costs” Are the Quiet Stress Multipliers

Not every “sell fast” search comes from being underwater on price. More often, it comes from being underwater on monthly stress:

- Insurance premiums doubling after a storm or risk re-rating.

- Property taxes ratcheting up with each reassessment.

- HOA fees, deferred maintenance, and rising utilities nibbling away left and right.

Search sentiment reveals sellers who technically “have equity” but emotionally feel like the house is using them, not the other way around.

The Four Seller Archetypes Hiding in the Data

Same zipcode. Same Zestimate. Completely different psychology.

Archetype 1: The Deadline Seller

They’re staring at a relocation date, a school-year reset, or a court timeline. Their search trail: “sell house before job move,” “close in 30 days,” “sell without contingencies.”

For them, the right question isn’t “What’s the absolute top price?” but “What’s the cost if this doesn’t close on time?” Double housing payments, missed opportunities, legal or family fallout—those are real dollar costs that belong on the net sheet.

Archetype 2: The Over-It Landlord

Their browser history blends “tenant behind on rent,” “eviction process [state],” and “we buy rental houses with tenants.” They’re not just selling a building; they’re selling a burden.

Using the Landlord Exit Calculator 2026 , we quantify whether one more lease renewal, one more turn, or one more rehab really makes sense—or if it’s time for a clean, as-is exit to an investor buyer like Local Home Buyers USA.

Archetype 3: The Silent Pre-Foreclosure Seller

They’re up late searching “missed mortgage payment help,” “can I sell in pre-foreclosure,” and “how long before auction date.” By the time they talk to anyone, the clock is dangerously short.

Here, Pre-Foreclosure Chess: Keep Your Equity or Lose It becomes the playbook: know your exact dates, understand your lender’s process, and decide whether a fast, certain as-is sale can preserve equity that would otherwise vanish.

Archetype 4: The Overwhelmed Heir or Estate Seller

Their search stack reads: “what to do with inherited house,” “sell house with siblings disagreeing,” “estate property needs work,” then eventually “sell house as-is with contents.”

The enemy is decision fatigue: endless contractor bids, family debates, and months of carrying costs. A data-backed as-is offer from Local Home Buyers USA lets families focus on the estate and each other—not on paint colors and punch lists.

From Search Exhaust to Strategy: How PropTechUSA.ai Powers Local Home Buyers USA

Your private search becomes a better offer—without becoming a product.

So how do we turn all this sentiment into something useful for a single seller on a single street?

1. We Read the Room (Not Your Name)

PropTechUSA.ai ingests aggregated, anonymized search patterns—not individual histories—to see where phrases like “sell my house fast,” “we buy houses,” and “stop foreclosure” are rising. We pair that with local data on jobs, insurance, taxes, and rents to identify where stress is building.

2. We Pre-Underwrite Risk, Not People

That market-level stress map helps us understand which homes and situations carry more timeline risk, rehab risk, or financing risk. Instead of guessing, Local Home Buyers USA uses that risk lens to structure offers and timelines that work in the real world, not just in a spreadsheet.

3. We Design Offers Around Your Reality

When you request an offer, we combine the macro picture with your micro truth: your deadlines, repairs, family dynamics, and next chapter. The outcome is a clear, data-backed cash offer you can compare against a traditional listing or doing nothing at all.

Brand promise: Local Home Buyers USA is the seller-facing brand you talk to. PropTechUSA.ai is the research arm that helps us show up with smarter, fairer options.

If You Just Searched “Sell My House Fast,” Here’s Your 5-Step Reality Check

-

1. Write Down Your Real Deadline

Is it a job start date, a court date, a foreclosure sale, or simply “before I burn out”? Put a real date on paper. Many sellers discover they have more runway—and more choices—than it feels like at midnight.

-

2. Calculate Your Monthly “Stress Cost”

Add your mortgage (or property tax), insurance, utilities, HOA, and known upcoming repairs. Then multiply by how many months you’d hold if you listed traditionally. That’s the silent “discount” you’re already giving away by waiting.

-

3. Decide How Much Work You Want to Do

Be brutally honest. Are you willing to manage contractors, showings, inspections, and renegotiations? Or does reading that sentence make your shoulders tense up?

Our Pre-Closing Checklist for Sellers breaks down what typically conveys, what “broom clean” really means, and which details you can stop obsessing over.

-

4. Get At Least Two Offers — and Compare Net, Not Just Price

A headline price means nothing without a net number. When you talk to Local Home Buyers USA, we’ll walk through:

- Our as-is cash offer.

- Costs we’re covering (repairs, closing costs in many cases, clean-out, etc.).

- The value of speed, certainty, and avoiding a second move.

Put that next to what a traditional agent estimates after commissions, repairs, holding costs, and fall-through risk.

-

5. Choose the Path That Matches Your Life, Not Just Your House

You’re not just moving numbers on a spreadsheet. You’re moving schools, commutes, relationships, and stress levels. The “best” outcome is the one that leaves you with the most net equity + peace of mind, not just the highest theoretical list price.

Want the Data-Backed Version of “Sell My House Fast”?

Skip the guesswork. Get a transparent, as-is cash offer from Local Home Buyers USA, powered by the market intelligence of PropTechUSA.ai.

Get My Cash Offer & Options BreakdownFAQs: Search Sentiment, “Sell Fast” Keywords & Your 2025 Options

It usually means your stress level has crossed a threshold—whether from money, time, or life changes. That doesn’t automatically mean you should grab the first lowball postcard or click the first ad you see, but it is a signal to pause, quantify your timeline and true costs, and explore multiple options before something (like foreclosure or a forced move) decides for you.

Many are, and some are not. A legitimate buyer will explain their process in plain English, show proof of funds, walk you through the contract, and encourage you to have your own attorney review it. At Local Home Buyers USA, we focus on transparency and options: if a traditional listing looks better for you, we’ll tell you that rather than pushing a deal that doesn’t fit.

No. Your searches are not reported to credit bureaus and don’t affect your score. What hurts credit are late payments, charge-offs, and foreclosures. That’s why acting early—when you’re still just searching and exploring—gives you more tools to work with and a better chance to protect both your equity and your credit.

It depends on your personal equation: monthly carrying costs, real deadline, repair budget, tax/insurance trajectory, and stress tolerance. Our affordability and landlord exit research, along with local agent conversations, can help you weigh a fast, certain sale against waiting for potential price upside. In many cases, choosing certainty + net clarity beats chasing a future maybe.

In many situations, yes—as long as you act before key legal deadlines. A qualified cash buyer can sometimes close quickly enough to pay off what you owe and prevent a completed foreclosure from hitting your record. The specifics depend on your state, your lender, and how far along the process is, so it’s critical to know your exact dates and options.

PropTechUSA.ai works with aggregated, anonymized patterns—not individual search logs. We care about where and why stress is rising, not who typed what. That macro signal helps Local Home Buyers USA show up in the right places with the right solutions, while your individual privacy remains protected.