Unified PropTechUSA.ai Net Offer Sheet

How our indices come together into a single, seller-facing offer with transparent line-items and guardrails.

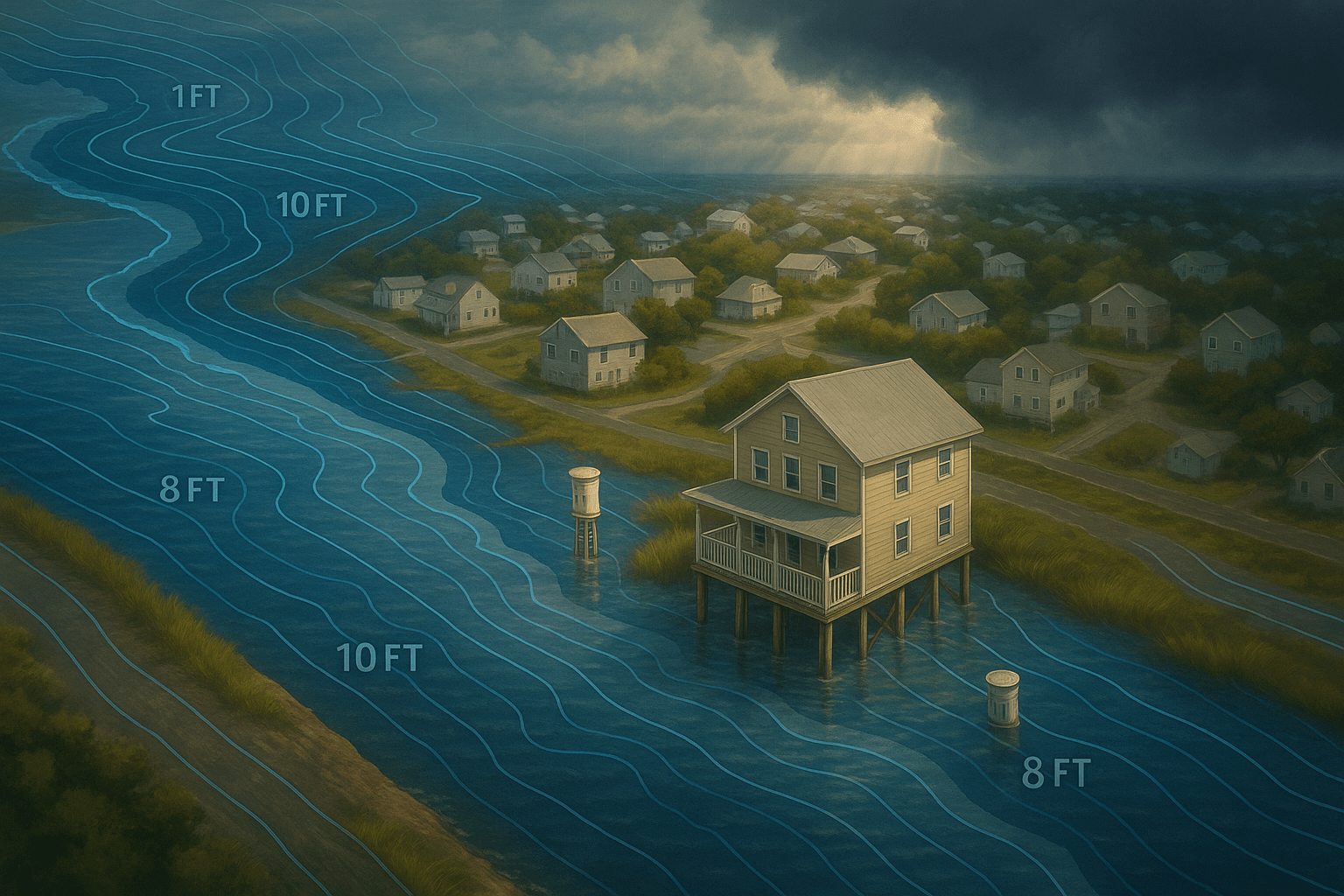

A data-journalism guide to FEMA’s modernized flood mapping and Risk Rating 2.0—how new flood zones, elevation rules, and premiums affect owners, buyers, and sellers in 2025. We’ll show you how to price, package, and still sell a coastal home with confidence.

Justin Erickson · CEO, Local Home Buyers USA · Updated

About the author: Justin Erickson leads Local Home Buyers USA, a nationwide team that purchases coastal properties “as-is,” coordinates title/escrow, and helps sellers navigate insurance, municipal, and environmental constraints—including flood-zone reclassifications. Our approach combines certainty (clean timelines, safe closings) with transparency (apples-to-apples net math, multiple exit structures).

Important: This guide is educational and not legal/insurance advice. For coverage and underwriting questions, consult a licensed insurance agent and your lender or attorney.

Flood Insurance Rate Maps (FIRMs) are FEMA’s regulatory maps showing Special Flood Hazard Areas (SFHAs) and Base Flood Elevations (BFEs). Communities adopt them for building codes, elevation requirements, and disclosure. For decades, NFIP premiums largely tracked those zones.

Risk Rating 2.0 modernized NFIP pricing by incorporating additional variables: distance to coast/river, elevation relative to water, flood frequency/severity, and property characteristics (foundation type, first-floor height, replacement cost). In plain English: two homes can share a zone but carry very different premiums.

Map risk is your regulatory category (SFHA vs. not). Premium risk is what it costs to insure your exact structure given elevation, distance, and replacement cost. Buyers often confuse the two—your job is to separate them with documents.

Because buyers compare neighbors. Under RR2.0, premiums can diverge due to structural details (first-floor height, foundation type) and property-level risk factors (distance to water, wave energy). A solid seller packet turns “random” into “explainable.”

Some communities add LiMWA (Limit of Moderate Wave Action) lines inside AE—areas with 1.5–3 ft breaking waves. For many buyers, LiMWA triggers “VE-style” scrutiny even if the zone letter is AE.

Think of pricing as a function of exposure and consequence:

Elevation Certificates (ECs) are not mandatory for RR2.0, but they’re still powerful. If your home is elevated above BFE (or has compliant flood openings and elevated systems), an EC can document the facts and reduce buyer anxiety—and sometimes improve quotes.

Private flood insurance has expanded. Some carriers price competitively for well-mitigated homes. When selling, collect both NFIP and private quotes with matching coverage/deductibles so buyers can compare apples-to-apples.

This console is designed for intuition, not precision. It helps you model two things at once: a simple risk/confidence snapshot and how three exit lanes—Cash, Novation Partner Sale, and Typical Retail Listing—can stack up on net dollars after time and friction.

If you only do one thing from this guide, do this: build a one-page, buyer-ready packet that answers the questions buyers and lenders ask before they ask them. That’s how you reduce renegotiations, reduce fall-through, and raise the number of serious offers.

“Hi — attached is our Coastal Seller Packet: FEMA map panel (effective & preliminary), elevation/mitigation details, and insurance quote options (NFIP + private). We’re ready for a clean close and can accommodate inspections quickly. Let us know your preferred closing date and any lender/insurance requirements so we can coordinate.”

Use these sources in your disclosure packet and listing documents. They’re stable, official, and updated:

Insurance effect: Mitigation documentation can improve both NFIP and private quotes. Even when premiums remain high, buyers accept costs more readily when they see the home is engineered correctly and the expected inundation depth at finished floor is low for common events.

Coastal deals reward certainty. If your home is well-elevated and documented, retail buyers may pay near-market. If elevation is marginal—or insurance is heavy—cash buyers may win once you model timeline risk, inspection drift, appraisal/insurance friction, and carrying costs.

For deeper pricing mechanics, see: Mortgage Spread Watch: 10Y vs. 30Y Fixed and Mortgage Rates at Yearly Lows — Buyer/Seller Playbook.

We buy coastal homes “as-is,” with clear timelines and safe closings. Get an apples-to-apples comparison of Cash vs. Novation vs. Retail—including insurance scenarios and net math for your specific ZIP.

Local title partners · Insurance coordination · 7–30 day closings · Transparent reports you can share with family or advisors.

Flood-zone deals live or die in the paperwork. Start title day one, lock insurance conversations early, and coordinate municipal items before the final walkthrough.

Want the fastest lane? Read our Same-Day Cash Offers Guide for the timeline compression checklist.

We’ll run your property through a simple, seller-friendly decision sheet: Cash vs. Novation vs. Retail, with timeline assumptions, insurance friction notes, and net math you can share with family or advisors.

Fastest path: start your seller packet above, then request your offer.

No—RR2.0 doesn’t require an EC. But an EC can document higher first-floor elevations, compliant openings, and other features that may reduce quotes and calm buyers. If your house is elevated, an EC often pays for itself in confidence.

Yes. Effective FIRMs generally govern lending until your community adopts the new maps. But buyers will price the preliminary information. Disclose both and label the status clearly in your seller packet.

Not always. Some policies decrease; others step up over time. Mitigation and alternative private quotes matter. The best seller move is to provide side-by-side quotes so buyers can plan.

Yes. We purchase “as-is,” coordinate title and insurance details, and can close in as little as 7–14 days with clear title. We’ll show cash vs. novation side-by-side so you choose the best net.

Explore the indices and pricing rails powering Local Home Buyers USA. We don’t guess. We model — then expose the math for sellers, partners, and regulators.

How our indices come together into a single, seller-facing offer with transparent line-items and guardrails.

Measures local absorption and buyer intensity to inform timelines and pricing power.

Quantifies the value unlocked by a Novation partnership relative to an as-is cash sale.

Estimates real-world hurdles to closing (ID, title, occupancy) and shows how tasks lower risk.

Composite execution-risk score that drives the transparent Certainty Adjustment in every offer.

Signals clarity of comps, HOA disclosures, and public data—improving expectations and timelines.

Macro-local health: employment, permits, inflation, delinquencies—expressed as a stability score.

Implementation notes and lead-gen calculator patterns for deploying FOS in production.

Models expected value from targeted repairs vs timeline risk under Novation or cash.

How time-to-close and execution risk translate into a fair, transparent adjustment.

Captures block-level sentiment and uncertainty that drive list-to-close variance.

Datasets, sources, and licensing (CC BY 4.0) for transparency and reproducibility.