PropTechUSA.ai Research • Local Home Buyers USA

Beyond “We Buy Houses”: Building a National Safety Net for Sellers the Traditional Market Leaves Behind

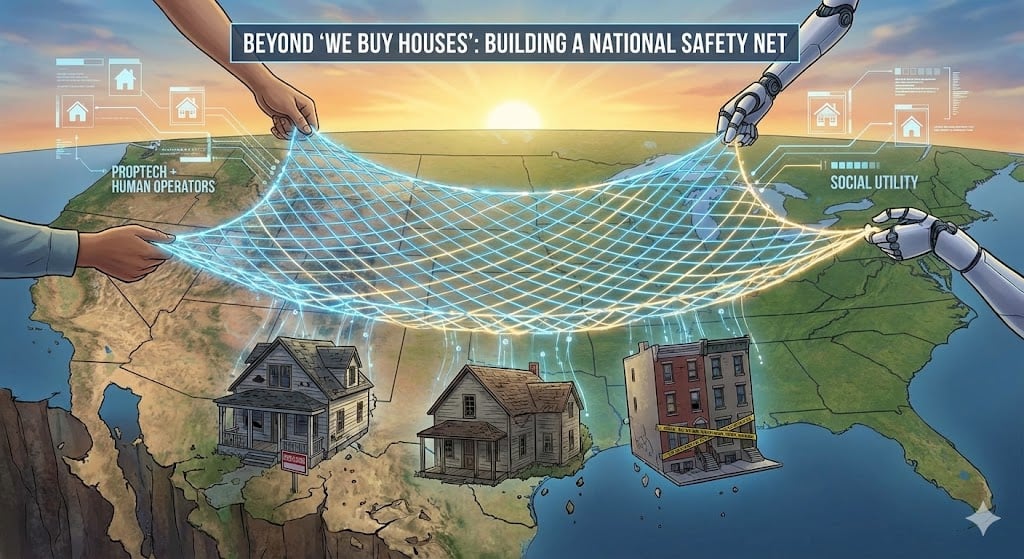

For decades, distressed homeowners had only two choices: hope the retail market saved them, or call a sign stapled to a utility pole. In 2025, that era is over. PropTech 2.0 is building something bigger: a national safety net for sellers the traditional system was never built to serve.

Sample network signal for illustration. Your property receives its own live, data-backed Safety Net profile. LESI = Listing Efficiency & Stress Index · BDI = Buyer Demand Index · FOS = Friction Overload Score.

The phrase “We Buy Houses” has been everywhere for years — yard signs, postcards, radio spots, billboards. The idea behind it is simple: a fast, flexible alternative for sellers who can’t — or shouldn’t — go through the full retail process.

But the industry has evolved. The needs of sellers have evolved. And in 2025, the once-scattered world of local investors and small operators is being replaced by something entirely different:

A coordinated, tech-enabled, data-backed safety infrastructure for sellers who fall between the cracks of the traditional real estate system.

At Local Home Buyers USA, powered by the research of PropTechUSA.ai, we’re building what comes after “We Buy Houses”: a nationwide seller safety net that combines real humans, real underwriting, real liquidity, and real protection.

This post breaks down why the traditional system fails millions of sellers each year — and what PropTech 2.0 must build to replace it.

Seller-Simplified: What This Actually Means for You

- You don’t have to “qualify” for a perfect retail listing to get real options.

- You see the math behind every path — retail, as-is, novation, or hybrid — not just one offer number.

- You can sell even with tenants, repairs, deadlines, or probate in the mix.

- You get one team, nationwide standards, and a clear timeline instead of guesswork.

The Traditional Real Estate Market Was Never Built for Distress

Despite all the proptech headlines, the American home sale process is still built for one type of seller:

- Owner-occupied

- Good condition

- Flexible timeline

- Financeable property

- Ability to prep, clean, show, negotiate, repair, and wait

But the real world doesn’t work like that.

Over 27% of U.S. homes now fall into one or more “non-retail-safe” categories:

- Deferred maintenance / systems failure

- Tenant-occupied or non-paying tenant cases

- Squatter situations

- Probate & inheritance timelines

- Foreclosure and pre-foreclosure

- Code violations or permit issues

- Unfinished renovations

- Vacant or abandoned property

- High insurance / tax burden areas

These sellers aren’t “low quality.” They’re just underserved — and the retail market is structurally unable to handle their constraints.

Which is why millions each year quietly search for alternatives. And why the next evolution of our industry has to be much more than a slogan on a corrugated plastic sign.

The Old “Investor World” Wasn’t a Safety Net — It Was a Patchwork

Historically, the alternative-to-retail market was built on small operators with vastly different:

- Underwriting standards

- Fee structures

- Ethics

- Capabilities

- Closing reliability

Some were elite. Some were… not. And sellers rarely knew which they were calling.

That patchwork model worked when the industry was small and hyper-local. But in 2025 — when the majority of distressed, urgent, or complex sellers are turning to Google first, not postcards — the bar has risen.

Sellers now expect:

- Real data

- Real transparency

- Real timelines

- Real offers backed by capital

- Real options — not a single take-it-or-leave-it number

They’re not looking for “an investor.” They’re looking for a safety net that behaves like infrastructure, not a gamble.

PropTech 2.0: The National Safety Net Sellers Needed All Along

At Local Home Buyers USA + PropTechUSA.ai, that safety net is built around four pillars:

1. Data Transparency (No More Mystery Discounts)

We show sellers the entire spectrum of outcomes — retail, as-is, novation, creative, liquidation — and the true net for each, instead of hiding behind one “investor price.”

Key tools in that ecosystem include:

- Compare Home Offers — side-by-side net sheets across exit paths.

- Zestimate Blind Spots Research — how AVMs miss real-life risk.

- Seller Stress & Liquidity Index — where sellers are under the most pressure.

- Home-Sale Sentiment & Predicted DOM — how long a listing is likely to sit.

2. Nationwide, Same-Day Underwriting

Instead of inconsistent local operators, we use unified underwriting logic and real-time data to evaluate:

- Micro-location risk (street-by-street, not just zip code).

- Repair scope and systems risk (roof, HVAC, plumbing, electrical).

- Insurance and tax pressure in your specific sub-market.

- Tenant, squatter, or occupancy complications.

The result is a same-day safety check on what’s realistically possible for your property and your timeline.

3. Flexible Liquidity Options (Not Just “Cash or Nothing”)

Sellers can choose from a menu, not a corner:

- Fast cash for maximum speed and certainty.

- Novation / partnership listings that share upside with our capital and construction.

- Wholetail exits where light upgrades meet investor-style speed.

- Creative structures for unique financing or occupancy needs.

- Timeline-indexed offers where your net adjusts with how quickly you need to close.

4. Human Protection Layer

Algorithms don’t solve probate. They don’t negotiate with a tenant who hasn’t paid in six months. They don’t sit with you when you’re deciding between keeping a house in the family or selling to move on.

Our acquisitions and advisory team acts as the connective tissue between data and reality — protecting sellers in the exact moments the market is most likely to fail them.

Safety Net Console: See Where You Fit on the Net (Interactive)

This is a simplified version of how our safety net triages cases nationwide. Answer a few quick questions and watch the console update your recommended path, urgency tier, and realistic closing window in real time. It’s not a contract — it’s a live explainer of how our team thinks about risk, stress, and timelines.

How to read this: based on your answers, a hybrid or partnership path likely gives you the best balance of net, timeline, and stress relief. A fast cash backstop can still sit underneath everything as a guaranteed floor if the market or circumstances shift.

This console is an educational model, not a commitment. Your actual Safety Net profile is built off live data, title, occupancy, and your state’s laws — then reviewed by a human before you ever sign.

Why This Matters: Most Sellers Who Need Help Never Raise Their Hand

Every year, millions of Americans deal with real-estate distress silently. They don’t want neighbors to know. They don’t want open houses. They don’t want their situation dissected in a group text.

But they desperately need:

- A fast option.

- A fair option.

- A private option.

- A trustworthy option.

- A no-pressure path with real timelines — not wishful thinking.

That is the safety net we’re building: a modern, data-driven, nationwide alternative that finally treats distressed and complex sellers as first-class citizens — not afterthoughts.

Need a confidential, data-backed second opinion?

See your options — retail, as-is, novation, or hybrid — in minutes, not months. No pressure, no obligation, just clean numbers.

FAQs: The National Seller Safety Net

Is this just “We Buy Houses” with a new brand?

No. This is a data-backed, multi-option safety net with transparent underwriting, nationwide standards, and research-driven tools — not a single take-it-or-leave-it number and a yard sign.

Do I have to take a cash offer?

No. We show all paths: retail, as-is, creative finance, novation, and partnership-based exits. You choose the path that matches your net, your timeline, and your stress level.

Can you help with tenants, squatters, or probate?

Yes. These are exactly the situations the safety net is designed for — cases many traditional agents avoid or struggle to shepherd to a clean closing.

What does it cost to get the analysis?

There is no fee for the analysis or net-sheet breakdown. Traditional fees only apply if you choose a retail or agent-based path that involves commissions and standard closing costs.

How fast can you actually close?

Many transactions close in 7–14 days, depending on title status, occupancy, and state requirements. In more complex cases, we’ll show you realistic timing ranges so you can plan around facts, not promises.