FSBO Fatigue: Why Many Owners Switch to Cash — and When It Makes Sense

FSBO promises control and savings. But after weeks of calls, showings, punchlists, and paperwork, many owners hit a wall: time and certainty matter more than a theoretical “maybe” price. This guide shows—step by step—how to decide if a clean, as-is cash sale (often 7–14 days) beats listing and waiting.

Illustrative metrics based on seller patterns we see nationwide. Your actual numbers depend on condition, price point, and micro-market.

Want a fair, fast option—without the FSBO grind?

We buy houses as-is, nationwide. Compare a 7–14 day cash exit vs. listing and waiting—side by side, in writing.

Transparent numbers. No obligations. You choose the timeline.

FSBO Gets Two Things Right—Price Control & Transparency

Listing “For Sale By Owner” can feel empowering because you set the price, control the showings, and talk directly to buyers. You also avoid listing commissions if you complete a direct buyer transaction. For the right home, in the right condition, in a hot micro-market, FSBO can work beautifully.

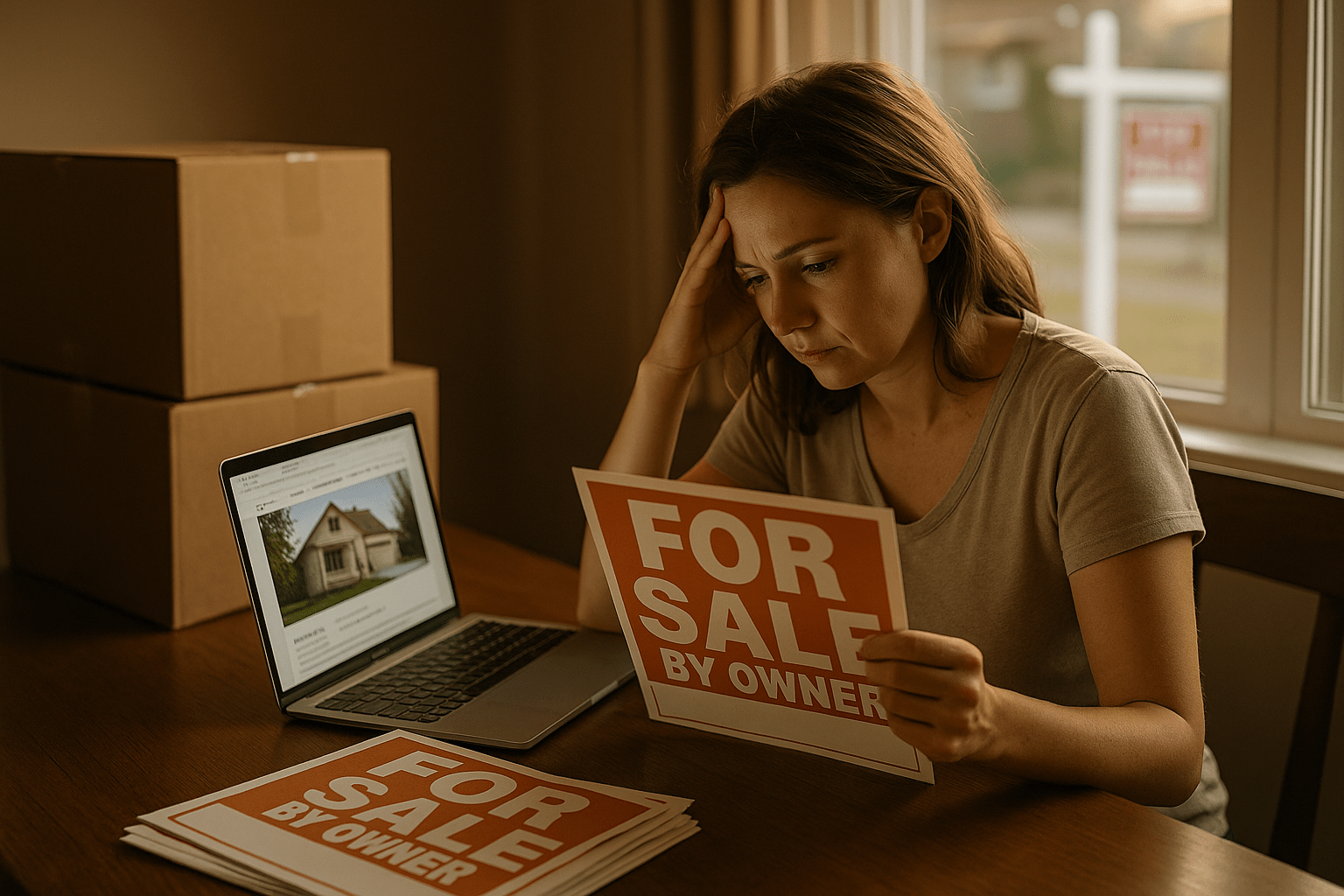

But the costs FSBO doesn’t advertise are time, coordination, and re-negotiation risk. You become your own project manager, marketer, transaction coordinator, and compliance gatekeeper—while living your life. After a few weeks, many sellers discover that the “savings” were quietly re-spent on carrying costs, concessions, repair overruns, and lost time.

This article isn’t anti-FSBO. It’s pro-clarity. If your FSBO path truly wins, we’ll say so. If a clean, as-is cash sale nets more life back (and often more money than you think), you’ll see that clearly too.

Are You Experiencing FSBO Fatigue? Five Reliable Signals

- Quality drift: Showing traffic exists, but preapprovals are thin, and contingencies multiply (“let me sell first,” “need closing costs”).

- Repair creep: Your “simple” punchlist expands; bids get pricier; contractors are booked; you fear re-inspections will re-open price.

- Inspection risk: You expect surprises. Meanwhile, a financed buyer’s appraisal and underwriting add new unknowns.

- Time burn: Every week costs mortgage, taxes, insurance, utilities, lawn/snow—and emotional bandwidth.

- Life events: Probate logistics, relocation, divorce, or downsizing mean time certainty beats theoretical upside.

These aren’t reasons to panic—they’re signals to perform a head-to-head comparison of your FSBO path versus a firm, verifiable cash option.

The Only Math That Matters: Net – Time – Certainty

Most comparisons stop at “commission saved.” That’s incomplete. The right model weighs:

- Net: Sale price − (repairs + concessions + carrying + fees + surprises)

- Time: Weeks to truly finish (not just “under contract”)

- Certainty: Probability of closing on the date you expect—without new costs

Retail buyers may offer a higher price—but they also introduce appraisal, loan approval, inspection credits, and schedule risk. A reputable cash buyer (like Local Home Buyers USA) offers a firm timeline, as-is condition, zero showings, and knowable costs. In many fatigue scenarios, the “discount” sellers fear is smaller than the real cost of waiting—and the life value of certainty is enormous.

Real Patterns We See (and What They Cost)

Across markets, the same FSBO patterns repeat:

- Cooling & walk-aways: Pretty offers die in underwriting or post-inspection; the home quietly ages on site. See Sellers Stuck in 2021: Buyers Walking in a Cooling Market.

- Seniors value simplicity: A guaranteed close date beats weeks of prep and showings. See Senior Sellers’ Playbook.

- Paperwork friction by state: FSBO rules differ across jurisdictions. See Selling Paperwork by State (2025).

- Multiple offers ≠ certainty: Highest isn’t always best. See How to Pick the Best Buyer.

- After escrow surprises: Know your rights if a buyer walks. See Florida Buyer Backs Out.

- Myths cost time: Learn the 2025 myths that mislead sellers. See Seller Market Myths.

Five-Minute Net Test: Will FSBO or Cash Win for Me?

- Weekly carrying cost: Mortgage + taxes + insurance + utilities + lawn/snow + your personal time value.

- Repair delta: Real bids to make it “retail-ready,” plus risk buffer for re-work after inspection.

- Concessions likelihood: Typical credits, rate buy-downs, or appraisal gaps in your micro-market.

- Cancellation probability: % of financed deals that fall apart late (ask your title/agent friends).

- Value of clean exit: What certainty is worth to your life right now (estate timelines, relocation, stress)?

Compare your expected FSBO net (price − real costs) against our as-is cash number using the console below with a 7–14 day close. If FSBO wins clearly, keep going. If not, reclaim your time and move on with confidence.

FSBO vs Cash Decision Console

Adjust the sliders and inputs to see how your FSBO path compares to a 7–14 day cash exit on net, time, and certainty.

Your Assumptions

We’ll assume this is an as-is offer with no repairs, showings, or fees.

Mortgage, taxes, insurance, utilities, lawn/snow, etc.

Modeled Outcome

After 10 weeks, repairs, concessions, and carrying costs of $0.

As-is, no repairs or showings, closing costs and fees built into the offer.

Adjust the numbers on the left to see whether FSBO or a 7–14 day cash exit is likely to leave you with more in your pocket.

Snapshot of your inputs

- FSBO price: $0

- Cash offer: $0

- Total carrying cost: $0

- Repairs + prep: $0

- Buyer concessions: $0

- Cancel risk (financed buyers): ~20%

This console is a planning tool, not an appraisal. For a live, written offer based on your property and market, use the form below.

Email Me This Analysis

Not ready to sell yet? Have a copy of this comparison sent to your inbox so you can revisit it later.

Common FSBO Objections—Answered with Reality

“If I wait, my number will come.”

Maybe. But carry costs and buyer leverage often grow with time on market. The “extra” sometimes never arrives—or arrives attached to concessions and delays. A firm, transparent number today can quietly beat a theoretical tomorrow.

“I’ll just fix what buyers want.”

If you have time, cash, and reliable contractors, this can work. But increasingly, re-inspections trigger new credits or delays. The as-is route removes the entire repair variable.

“Cash buyers lowball.”

Bad ones do. Good ones price certainty. We share our math, close on your schedule, and step aside if your FSBO path truly wins. Reputation > any single deal.

Why FSBO Sellers Choose Local Home Buyers USA

- As-Is, No Repairs: Skip punchlists and re-inspections.

- Fast Closing (7–14 days when needed): Or choose a date that fits your life.

- No Showings or Open Houses: Privacy preserved, schedule respected.

- Transparent Numbers: We model FSBO vs. cash so you can decide on net, time, and certainty.

- Nationwide with Local Knowledge: 50 states, practical help with probate, payoff, and paperwork.

Compare Your Paths: FSBO vs. 7–14 Day Cash Exit

Tell us your timeline, condition, and goals. We’ll provide a clean, side-by-side analysis—no pressure.

If FSBO wins, we’ll say so. If certainty wins, you’ll know it fast.

About the Author

Founder & operator across multiple U.S. markets. Focus: fast, certain seller outcomes—including probate, pre-foreclosure, and as-is exits—using clear math and transparent timelines.

Get My Cash Options (No Repairs. No Fees.)

How a Cash Home Sale Works (2-Minute Explainer)

Tired of FSBO Uncertainty?

Get a transparent, as-is cash option that can close in 7–14 days. We’ll compare it to your FSBO path—so you can decide with confidence.

No obligations. We respect your timeline and privacy.

Research Hub — Indices, Methods & Transparency

Explore the indices and pricing rails powering Local Home Buyers USA. We don’t guess. We model — then expose the math for sellers, partners, and regulators.

Unified PropTechUSA.ai Net Offer Sheet

How our indices come together into a single, seller-facing offer with transparent line-items and guardrails.

Buyer Demand Index (BDI)

Measures local absorption and buyer intensity to inform timelines and pricing power.

Partnership Value Index (PVI): Novation vs Cash

Quantifies the value unlocked by a Novation partnership relative to an as-is cash sale.

Closing Risk Score (FOS)

Estimates real-world hurdles to closing (ID, title, occupancy) and shows how tasks lower risk.

How We Price Risk (RCI)

Composite execution-risk score that drives the transparent Certainty Adjustment in every offer.

Local Market Transparency Score (LMTS)

Signals clarity of comps, HOA disclosures, and public data—improving expectations and timelines.

Local Economic Stability Index (LESI)

Macro-local health: employment, permits, inflation, delinquencies—expressed as a stability score.

Friction-to-Offer Score (Methods)

Implementation notes and lead-gen calculator patterns for deploying FOS in production.

Renovation Value Index (RVI)

Models expected value from targeted repairs vs timeline risk under Novation or cash.

Cost of Certainty — Pricing Time & Risk

How time-to-close and execution risk translate into a fair, transparent adjustment.

Beyond Zestimate — Anxiety Premium (Hyperlocal Sentiment)

Captures block-level sentiment and uncertainty that drive list-to-close variance.

Research Data Catalog & License

Datasets, sources, and licensing (CC BY 4.0) for transparency and reproducibility.