Cash Offer vs. Assumable Loan: What Nets More in 2026?

Assumable mortgages are back—especially where legacy sub-4% loans still exist. But do assumption deals actually beat a strong cash offer on your net after fees, repairs, and time? Below, we break down the math, timelines, due-on-sale risk, and real-world tradeoffs so you can choose the path that protects your equity—and your sanity.

Reviewed by the Local Home Buyers USA Editorial Board • Updated

Contact: sales@localhomebuyersusa.com • 1-800-858-0588

Move the sliders to reflect your home’s reality—price, repairs, carrying drag, and cash strength. We’ll estimate a time-adjusted net for both paths and highlight the provisional winner.

This console is an illustrative planning tool, not legal or tax advice. We can run state-specific comps and fees once you share the property address.

Assumable Loans 101

An assumable mortgage lets a buyer take over your existing loan’s balance and interest rate—subject to lender approval and program rules. Government-backed loans (FHA/VA/USDA) are the most commonly assumable; most conventional loans are not.

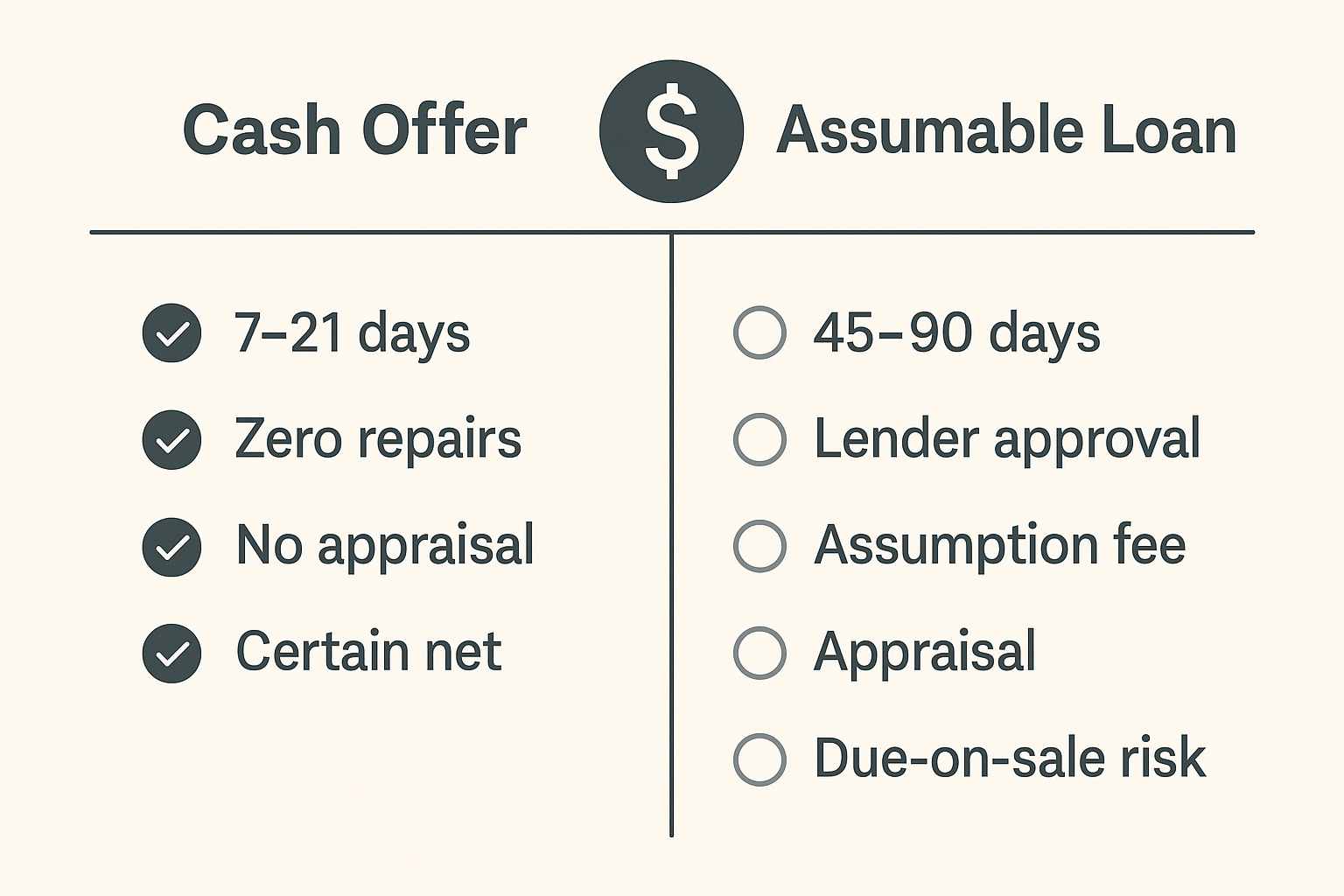

- Pros: Keeps a low rate in place for the buyer; can boost demand and headline price.

- Cons: Longer timeline, assumption fees, appraisal risk, strict underwriting, and potential due-on-sale exposure if structure deviates from guidelines.

Typical cost & time line-items (assumption)

- Assumption fee: about $900–$1,500+ (servicer)

- Processing & credit: $50–$150

- Appraisal: $500–$900

- Title/escrow: market-dependent

- Time to close: 45–90 days

- Buyer equity gap: cash or a second lien

Cash Offers 101

A verified cash buyer removes lender conditions and insurance requirements, allowing certainty and speed with fewer moving parts. Any discount reflects the buyer’s risk, repair capital, and carrying costs—not bank friction.

- Pros: 7–21 day closings, no appraisal, no repairs, flexible occupancy, and high certainty.

- Cons: Headline price can be lower than a best-case retail assumption—but net often compares favorably once fees, repairs, and time are included.

NET-PROCEEDS MATH: Cash vs. Assumable (Apples to Apples)

We compare time-adjusted net—because each extra month adds taxes, insurance, HOA, mortgage interest, utilities, and market risk. Use these frameworks and slot in your numbers.

Scenario A: House is list-ready (cosmetics only)

| Line Item | Cash Offer | Assumable Loan |

|---|---|---|

| Headline price | $300,000 | $318,000 |

| Repairs before closing | $0 | $3,500 (touch-ups / safety) |

| Assumption + lender fees | $0 | $1,400 |

| Appraisal / re-inspection | $0 | $750 |

| Concessions/credits | $0 | $4,000 |

| Title/escrow & recording | $3,000 | $3,000 |

| Carrying cost (mo. × months) | $1,200 × 0.75 = $900 | $1,200 × 2.5 = $3,000 |

| Estimated Net | $296,100 | $305,350 |

Takeaway: In light-repair markets with buyer demand for low-rate loans, an assumption can edge out on net—if timelines hold and no retrade occurs.

Scenario B: House needs meaningful work (roof/HVAC)

| Line Item | Cash Offer | Assumable Loan |

|---|---|---|

| Headline price | $290,000 | $320,000 |

| Repairs before closing | $0 | $18,500 |

| Assumption + lender fees | $0 | $1,600 |

| Appraisal / re-inspection | $0 | $900 |

| Concessions/credits | $0 | $7,500 |

| Title/escrow & recording | $3,000 | $3,200 |

| Carrying cost (mo. × months) | $1,200 × 0.6 = $720 | $1,200 × 3.0 = $3,600 |

| Estimated Net | $286,280 | $284,700 |

Takeaway: With meaningful repairs, cash wins on net because assumption buyers and lenders typically require fixes.

Scenario C: HOA & insurance shock (carrying drag)

| Line Item | Cash Offer | Assumable Loan |

|---|---|---|

| Headline price | $305,000 | $325,000 |

| Repairs before closing | $0 | $6,000 |

| Assumption + lender fees | $0 | $1,500 |

| Appraisal / re-inspection | $0 | $750 |

| Concessions/credits | $0 | $4,000 |

| Title/escrow & recording | $3,000 | $3,200 |

| Carrying cost (mo. × months) | $1,850 × 0.75 = $1,388 | $1,850 × 2.5 = $4,625 |

| Estimated Net | $300,612 | $304,925 |

Due-on-Sale, Equity Gaps & Risk Controls

- Due-on-sale: Most notes allow the lender to call the loan due if title transfers without consent. Follow the lender’s formal assumption process. Avoid off-book structures that violate program rules.

- Equity gap funding: Buyer must pay your equity above the loan balance. If they can’t, expect price cuts, a second lien, or a failed escrow.

- Appraisal risk: If the appraisal lags, lenders reduce maximum assumable amount or require repairs/credits.

- Timeline creep: Servicer processing and HOA payoff delays can push 45-day targets to 60–90 days.

- Insurance/inspections: Assumption buyers often need active hazard insurance and clean 4-point/wind-mit reports in certain states.

When Each Path Likely Wins

When an Assumable Loan Likely Wins

- Loan is FHA/VA/USDA at ≤3.5% and buyer can bridge equity

- Home is list-ready with light/no repairs

- High-demand submarket; multiple qualified buyers

- Servicer is known for fast assumption processing

If you meet 3–4 of these, test the market—while holding a backup cash number.

When a Cash Offer Likely Wins

- Repairs needed (roof, HVAC, electrical, foundation)

- Insurance headaches or HOA/tax carrying cost is heavy

- Timeline matters (relocation, probate, pre-foreclosure)

- Uncertainty is costly (vacancy, vandalism, code issues)

Datasets (Open License, Attributed)

To keep this guide actionable, we publish two small, illustrative datasets licensed under CC BY 4.0. You may reuse them with attribution to “Local Home Buyers USA — Author: Justin Erickson”.

Dataset A — Assumption Timeline Benchmarks (2026 Illustrative)

| Loan Type | Servicer Speed | Common Extras | Typical Days to Close |

|---|---|---|---|

| FHA (owner-occ) | Medium | Appraisal + 4-point in some states | 45–70 |

| VA (eligible buyer) | Medium-Fast | Funding fee; entitlement transfer checks | 40–65 |

| USDA | Slow | Rural eligibility verification | 60–90 |

| Conventional (rare) | Varies | Case-by-case approvals | 45–90 |

Dataset B — Time-Adjusted Net Framework

| Variable | Description | Cash Offer | Assumable |

|---|---|---|---|

| Headline Price | Offer or contract price | Lower | Higher (if low rate) |

| Repairs Pre-Close | Work needed to pass underwriting | $0–minimal | Often required |

| Fees | Assumption, appraisal, concessions | Minimal | Moderate |

| Carrying Cost | Monthly costs × months to close | Low (0.5–1 mo.) | Medium (2–3 mo.) |

| Fall-Through Risk | Probability of restart | Low | Higher |

These illustrative patterns are derived from our internal deal history and industry observation. License: CC BY 4.0 — “Local Home Buyers USA, Author: Justin Erickson”.

Frequently Asked Questions

Are all loans assumable?

No. FHA/VA/USDA typically allow assumptions subject to rules. Most conventional loans are not assumable.

What about the due-on-sale clause?

Most notes allow the lender to call the loan due if the property transfers without consent. Use the lender’s formal assumption process and approved structures.

Can an assumption fail late in escrow?

Yes—common reasons include appraisal shortfalls, slow servicer processing, or buyer equity gaps. Keep a backup cash option.

How do I know my net?

Build a side-by-side net sheet with honest repair and carrying assumptions—or ask us to compute both paths with local comps and line-items.

Related Guides & Pages

About Local Home Buyers USA

Local Home Buyers USA purchases homes nationwide in any condition. We provide same-day cash numbers, flexible close dates, and insured closings through licensed title partners. We also help sellers evaluate retail, assumption, or creative options—net first, not hype first.

Author: Justin Erickson, CEO • sales@localhomebuyersusa.com • 1-800-858-0588

Watch: Cash vs. Assumable — Net-Sheet Walkthrough

Want a transparent number for both paths?

We’ll run the net sheet for cash vs. assumption and show you the winner—including fees, repairs, and realistic timelines.See Your Winner: Cash vs. Assumable (Net-Sheet Ready)

We’ll calculate both paths—fees, repairs, carrying time—and give you a date-certain close. Many sellers choose certainty within 7–21 days.

Easy dismiss: click outside, press Esc, or tap the ×.

Research Hub — Indices, Methods & Transparency

Explore the indices and pricing rails powering Local Home Buyers USA. We don’t guess. We model — then expose the math for sellers, partners, and regulators.

Unified PropTechUSA.ai Net Offer Sheet

How our indices come together into a single, seller-facing offer with transparent line-items and guardrails.

Buyer Demand Index (BDI)

Measures local absorption and buyer intensity to inform timelines and pricing power.

Partnership Value Index (PVI): Novation vs Cash

Quantifies the value unlocked by a Novation partnership relative to an as-is cash sale.

Closing Risk Score (FOS)

Estimates real-world hurdles to closing (ID, title, occupancy) and shows how tasks lower risk.

How We Price Risk (RCI)

Composite execution-risk score that drives the transparent Certainty Adjustment in every offer.

Local Market Transparency Score (LMTS)

Signals clarity of comps, HOA disclosures, and public data—improving expectations and timelines.

Local Economic Stability Index (LESI)

Macro-local health: employment, permits, inflation, delinquencies—expressed as a stability score.

Friction-to-Offer Score (Methods)

Implementation notes and lead-gen calculator patterns for deploying FOS in production.

Renovation Value Index (RVI)

Models expected value from targeted repairs vs timeline risk under Novation or cash.

Cost of Certainty — Pricing Time & Risk

How time-to-close and execution risk translate into a fair, transparent adjustment.

Beyond Zestimate — Anxiety Premium (Hyperlocal Sentiment)

Captures block-level sentiment and uncertainty that drive list-to-close variance.

Research Data Catalog & License

Datasets, sources, and licensing (CC BY 4.0) for transparency and reproducibility.