Unified PropTechUSA.ai Net Offer Sheet

How our indices come together into a single, seller-facing offer with transparent line-items and guardrails.

Indicators shown in the ticker are illustrative only.

Illustrative data — see CFPB, FBI IC3, Fedwire, FDIC, ALTA & MISMO sources below.

Title • Escrow • Safe Disbursement • Updated

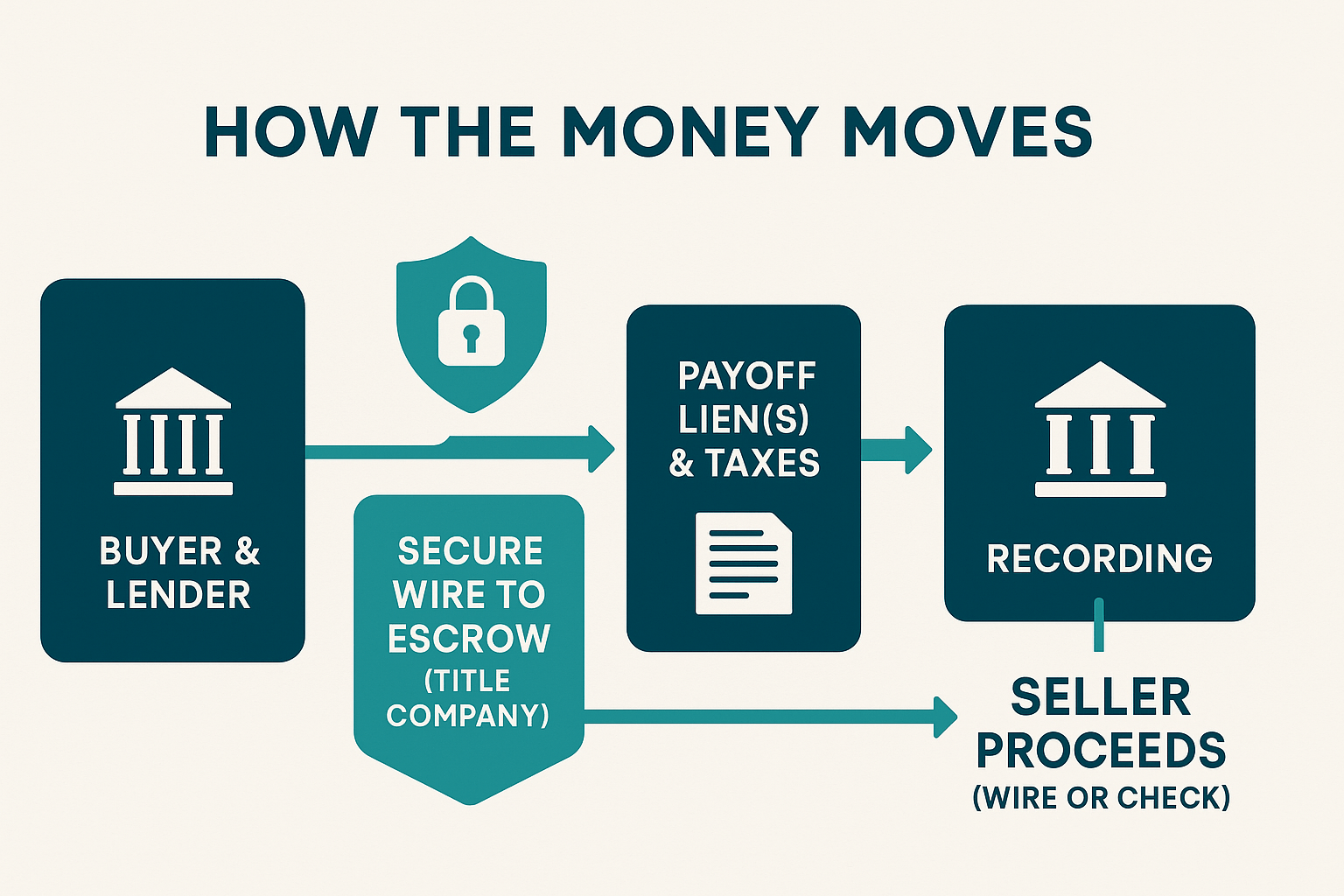

At the table you see IDs, signatures, and a notary stamp. Behind the scenes, a title company runs a tightly controlled sequence: clearing title, matching incoming wires, paying off liens, recording the deed, and then disbursing your net proceeds. This is how your equity gets from the buyer's bank to your account safely.

Helpful resources: How It Works • Get Offer • Contact

On your side of the table there are signatures, IDs, and a notary stamp. Behind the scenes, a title company coordinates dozens of steps that must occur in a precise order. Think of three parallel threads, each audited:

When all three stay synchronized, the flow of money is safe by design. If anything is incomplete, a competent closer pauses funding. That conservative posture protects your equity.

Escrow "opens" when your executed contract lands at the title company. Early tasks:

If you need help coordinating documents or timelines, our team can walk you through the steps on the How It Works page.

Here's the high-level path at reputable title firms. Use the interactive simulator below to visualize safeguards, the record→disburse rule, and exception handling in real time.

Wire instructions verified via known phone

Funds held in FDIC-insured escrow

Deed recorded before disbursement

Trust balanced to the penny

Best practice: Release final proceeds only after recording confirmation. Customs vary by county; ask your closer how they handle the record → disburse sequence.

Whether the buyer is paying cash or financing, funds flow into a segregated escrow trust account. The closer provides wiring instructions securely (never plain email), the bank sends a wire over Fedwire®, and escrow posts the deposit after internal controls confirm receipt.

Need a walkthrough of our standard steps? Visit How It Works.

Escrow pays everything that legally must be paid before you get proceeds:

Payoff quotes carry per-diem interest and expire. If closing slides, the closer refreshes quotes and updates your statement.

After signatures and cleared funds, the title company submits the deed (and, if applicable, the buyer's mortgage) to the county recorder. Many counties support eRecording. When confirmation returns, escrow releases wires per the statement—payoffs first, then your proceeds.

| Order | Action | Reason |

|---|---|---|

| 1 | Confirm all signatures & IDs | Compliance; prevents fraud |

| 2 | Verify funds cleared | Good-funds requirement |

| 3 | Record deed (& mortgage) | Legal transfer is official |

| 4 | Release wires per statement | Payoffs → net to seller |

| 5 | Issue title policies | Buyer/lender coverage |

| 6 | Archive audit trail | Underwriter/regulator review |

Most sellers prefer a wire transfer for speed. Same-day arrival is common if released before bank cut-offs. Cashier's checks are possible, but banks may place holds.

If speed and certainty matter, start your secure cash offer.

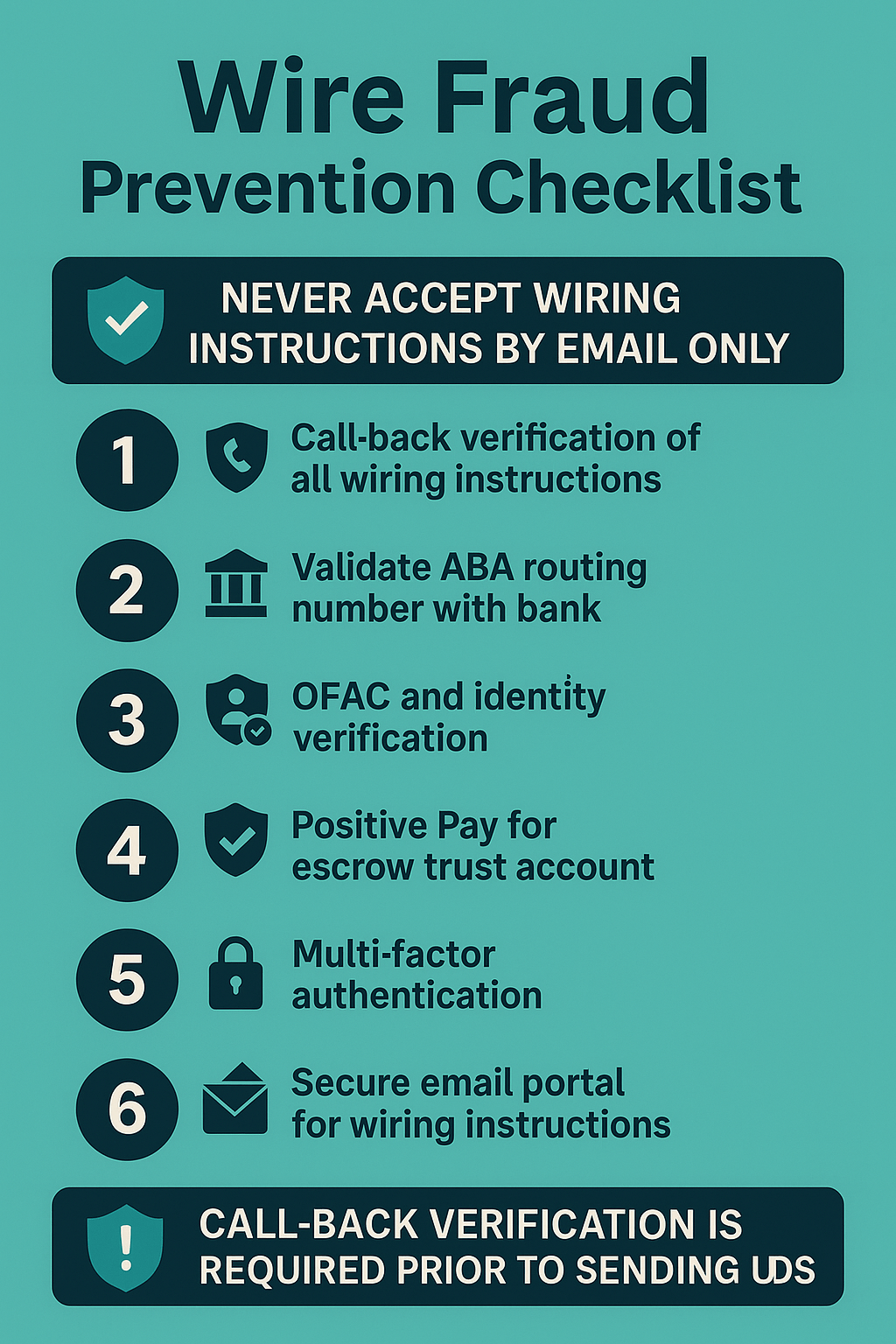

Real-estate wire fraud (a subtype of BEC) is persistent. Disciplined procedures cut risk dramatically. For trends, see FBI IC3 Annual Reports and relevant FinCEN Advisories.

Never rely on email alone for wiring instructions—call the title office using a number you look up. Review consumer complaints by topic in the CFPB database.

Title companies reconcile their escrow trust daily so deposits and disbursements align to the penny. Underwriters and state regulators audit these logs. A good closer can show you incoming wire advices, payoff confirmations, recording receipts, and your proceeds wire confirmation.

Industry frameworks: ALTA Best Practices, MISMO, and security expectations from the FFIEC InfoSec Booklet.

Expect letters of administration, sale authorization, or small-estate affidavits.

Associations can block closing for unpaid dues or assessments. Title orders an estoppel; ask early about transfer fees or upcoming assessments.

Some cities record utility or nuisance liens. Municipal lien letters reveal these; most are paid from proceeds.

Common names create false positives; identity affidavits resolve them. Real judgments require payoffs before funding.

County and bank cut-offs vary, but the sequence remains record → disburse.

We buy across 16+ states and coordinate with reputable, licensed title partners to protect your proceeds. No repairs. No fees. No surprises.

Primary datasets and standards relevant to escrow controls, wire safety, and recording. Public-sector materials are generally public domain; private standards require attribution and have reuse limits.

Public domain note: U.S. Government publications are generally in the public domain (citation requested). Private-sector standards (ALTA, NACHA, MISMO) carry copyright and specific reuse terms—link and attribute without redistributing proprietary content.

No. Many title companies support mobile notaries and remote online notarization (RON) where available. If you're out of state, your closer can coordinate signing and still wire your proceeds on recording.

Often yes. Contracts or local customs may suggest a default, but parties can usually agree to a mutually trusted firm. If you're selling to us, we work with reputable partners and can accommodate your preference.

Your closer obtains payoff demands and adjusts the settlement. If something can't be cured the same day, the file pauses until the defect is resolved. That's exactly what escrow is for—safety first, then funding.

Wires usually arrive the same business day if released before bank cut-off; otherwise, next business day. Checks are slower and may be subject to bank holds. If speed matters, begin with a secure cash offer.

Great title work is invisible because it prevents problems you'll never see. When funds move safely—from buyer, to lender, to escrow, to lienholders, to the recorder, and finally to you—it's because a disciplined closer insisted on correct documents, correct numbers, and correct procedures. That's how your equity arrives intact. If you want the fastest, cleanest exit, start your cash offer and let us coordinate a no-drama closing with licensed title partners.

Explore the indices and pricing rails powering Local Home Buyers USA. We don’t guess. We model — then expose the math for sellers, partners, and regulators.

How our indices come together into a single, seller-facing offer with transparent line-items and guardrails.

Measures local absorption and buyer intensity to inform timelines and pricing power.

Quantifies the value unlocked by a Novation partnership relative to an as-is cash sale.

Estimates real-world hurdles to closing (ID, title, occupancy) and shows how tasks lower risk.

Composite execution-risk score that drives the transparent Certainty Adjustment in every offer.

Signals clarity of comps, HOA disclosures, and public data—improving expectations and timelines.

Macro-local health: employment, permits, inflation, delinquencies—expressed as a stability score.

Implementation notes and lead-gen calculator patterns for deploying FOS in production.

Models expected value from targeted repairs vs timeline risk under Novation or cash.

How time-to-close and execution risk translate into a fair, transparent adjustment.

Captures block-level sentiment and uncertainty that drive list-to-close variance.

Datasets, sources, and licensing (CC BY 4.0) for transparency and reproducibility.