Unified PropTechUSA.ai Net Offer Sheet

How our indices come together into a single, seller-facing offer with transparent line-items and guardrails.

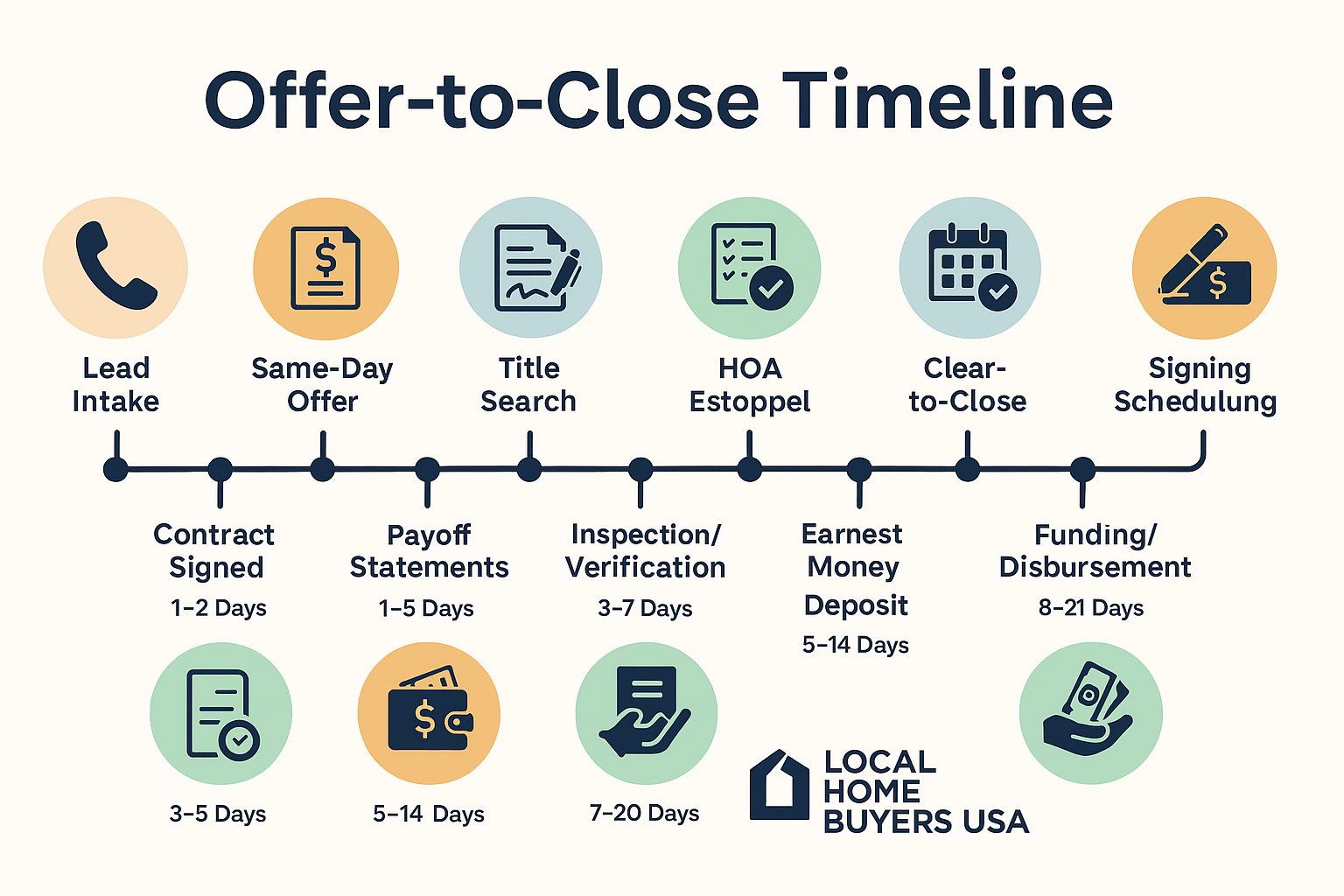

This is the no-drama map from signed offer to money in your account. We break down every milestone, who owns which task, and the documents you’ll touch—plus wire safety, net proceeds, and a faster as-is option when certainty beats delay.

Interactive Console

Flip between a traditional financed buyer and a Local Home Buyers USA as-is cash exit. Add real-world frictions—HOA, probate, tenants—and the console estimates your closing window, complexity band, and document load.

We’ll compare your target to a realistic closing window for this scenario.

Friction Flags

Flip these on and off to see how they stretch the calendar and increase document load.

Console Output

Projected Closing Window

10–14 days

If you signed today, closing around —.

Complexity Band

Moderate

Clean title with a few moving pieces. Expect a manageable closing if everyone does their job.

Document Load

≈ 14 docs

Core contract & disclosures, title package, closing statement, deed, and wire instructions.

| Milestone | Approx. Day | Primary Owner |

|---|

This studio is educational, not legal or lending advice. We use a more detailed version inside PropTechUSA.ai when we build your actual net sheet and closing plan.

A clear plan turns a stressful process into a sequence of ordinary steps. Here’s the high-level flow every seller should understand before signing—and what will (and won’t) happen along the way.

You and the buyer agree on price and terms. Earnest money deposit (EMD) is usually due within 1–3 business days. A tight EMD timeline signals commitment; loose timelines introduce risk.

The closer orders the title search, requests payoff statements, and calendars key dates. This is where hidden issues surface (liens, judgments, unpaid utilities, or estate matters).

Financed deals often include inspection windows and repair requests. A real as-is cash offer typically prices repairs upfront and minimizes renegotiations.

Lenders require appraisals. Cash buyers may use internal valuation and skip appraisal delays entirely.

The title report lists exceptions (easements, encroachments, liens) and any curative steps. Payoffs are requested and verified in writing.

Every condition is satisfied: title is clear, lender (if any) is ready, and signing is scheduled. You receive preliminary figures to review.

Remote online notary (where available) or in-person signing. Identity verification is strict; wire instructions must be confirmed by phone to prevent fraud.

Funds disburse after signatures and required recording/confirmations. You get paid by wire or check. Simple, but only when steps 1–7 were done correctly.

Shut off or transfer utilities, cancel insurance per carrier guidance, and set mail forwarding. Post-occupancy (if agreed) is governed by a short, clear addendum.

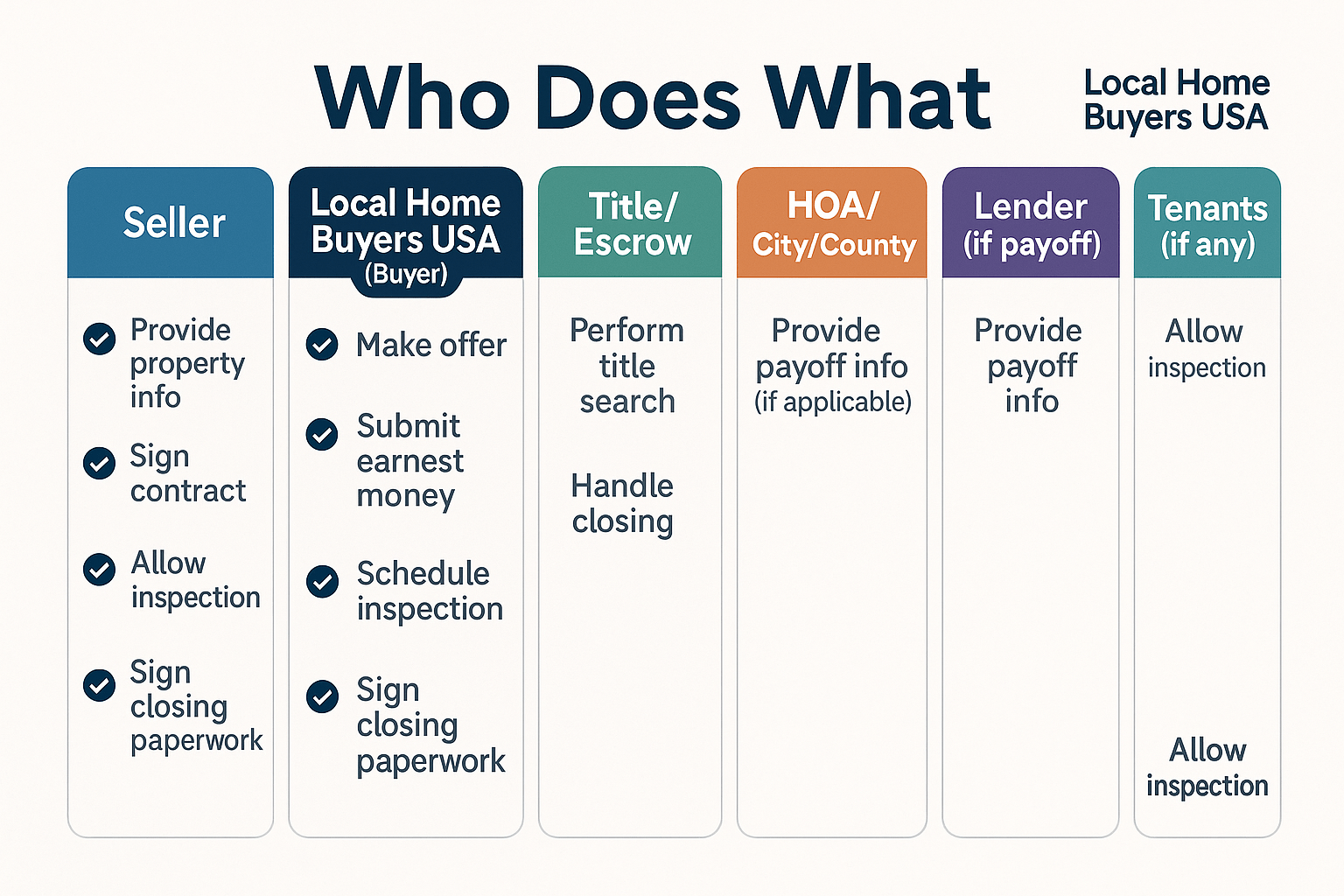

Confusion fades when responsibilities are explicit. Share this table with everyone on the deal so expectations stay aligned.

| Party | Primary Responsibilities |

|---|---|

| Seller | Provide access; complete disclosures where required; share payoff, HOA, and municipal info; review net sheet; sign closing docs; coordinate utilities and move-out. |

| Buyer | Fund EMD; complete inspections (if any); secure financing (if applicable); line up insurance; complete walkthrough; close per contract. |

| Title/Escrow | Search & commitment; coordinate curatives; request & verify payoffs; prepare ALTA/CD; manage signing; disburse funds; record documents. |

| Lender | Underwriting; appraisal; closing conditions; wire funds to title. |

| HOA/COA | Provide estoppel/resale package; confirm dues, violations, and transfer steps. |

| Municipality | Issue certificates (occupancy, smoke/CO, POS); collect local transfer fees if applicable. |

| Insurance | Buyer’s binder; seller cancels after confirmation of transfer/recording per carrier guidance. |

Documents vary by state and property type, but the core pattern is stable. Use the expandable sections to preview what you’ll sign and why it matters.

Read dates carefully: inspection, financing, title, and closing. Missed dates = leverage lost.

A clean commitment is your green light. Exceptions remain unless cured or insured around—ask your closer to translate the legalese.

Appraisals add time and volatility. Cash valuation compresses the calendar and minimizes re-trades when priced honestly.

Your closer will send a draft ALTA/CD. Read line-by-line; ask for clarifications before signing day.

Every day has a job. The only question is whether the process is predictable. Here’s the side-by-side view sellers use to choose between speed and potential upside.

| Milestone | Traditional (Financed Buyer) | As-Is Cash (Local Home Buyers USA) |

|---|---|---|

| Offer Accepted ➜ EMD | Day 0–3 | Day 0–1 |

| Open Title / Order Payoffs | Day 1–2 | Day 1 |

| Inspection Window | Days 3–10 | Usually N/A (repairs priced into offer) |

| Appraisal Ordered | Days 5–12 | N/A (cash) |

| Title Commitment | Days 5–10 | Days 3–7 |

| Clear Conditions | Days 12–25 | Days 5–10 |

| Schedule Signing | Days 20–30 | Days 7–12 |

| Funding & Recording | Day 25–35 | Day 10–14 (can be faster with clear title) |

Ranges are typical—not guarantees. Title findings, HOA timing, and local requirements drive variance. Ask for a milestone calendar on day one.

Some states rely heavily on attorneys for contract review and closing; others rely on title/escrow companies. The effect is timing: scheduling and document prep may take longer in attorney-driven markets; title states can be quicker when files are clean.

Condos and HOA communities often require estoppels, resale packages, or approvals. Cities may require occupancy certificates or point-of-sale inspections. These introduce fixed waits—start them early.

If you’re an executor or personal representative, timing depends on authority (letters testamentary/administration) and court status. Curatives (e.g., missing releases) add days. Clear communication reduces surprises.

Lease terms control access and timing. Some buyers keep tenants; others request possession at close. Cash buyers can align closing dates with notice windows or negotiate relocation assistance.

Lender underwriting is the largest wild card: appraisal scheduling, conditions, and verification steps can stretch timelines. Cash compresses them.

Storms, freezes, and holidays slow scheduling, repairs, and municipal offices. Plan buffers around known slow periods.

It’s not what you sell for. It’s what you walk away with. Here’s a structure that translates sticker price into spendable dollars.

| Line | Value | Notes |

|---|---|---|

| Contract Price | $__________ | Headline price buyers quote |

| – Title/Escrow/Recording | ($__________) | Varies by state and company |

| – Transfer/Local Taxes | ($__________) | Seller/buyer split varies by locale |

| – HOA/Condo/City Certificates | ($__________) | Estoppels, resale packages, municipal checks |

| – Mortgage Payoff(s) + Per-Diem | ($__________) | Title confirms exact payoff with interest to close |

| – Seller Credits/Concessions | ($__________) | Common in financed deals after inspection |

| – Repairs or Repair Credits | ($__________) | As-is cash prices these upfront |

| – Carrying Costs (X weeks) | ($__________) | Taxes, utilities, insurance during waiting period |

| = Estimated Net | $__________ | What you keep |

Unreleased mortgages, mechanics’ liens, or old judgments can stall a closing. Many sellers don’t know until the search returns.

Condo and HOA paperwork can take days. If there are violations, fines may be due.

Financed buyers may ask for repairs or credits after inspection, changing your net or timeline.

An appraisal below contract price can trigger fresh negotiations or kill financing.

Bad actors spoof emails with updated wire instructions. It’s common—and devastating.

Helpful resources: consumerfinance.gov · ftc.gov

Problem: Two siblings inherited a vacant property ahead of winter storms. Title revealed an old, unreleased mortgage.

Plan: Title obtained payoff confirmation from the successor servicer. As-is cash buyer priced foundation and roof risk upfront; no inspection re-trades.

Outcome: Closed in 9 business days after clear title. Siblings avoided months of utilities and vacant-home risk.

Problem: Seller needed proceeds to secure housing tied to a new job. Financed buyers introduced appraisal risk.

Plan: Seller compared net sheets and chose an as-is cash buyer to match the employment start date. Post-occupancy addendum gave a 5-day buffer.

Outcome: Closing aligned with relocation package; zero storage costs; smooth handoff.

Problem: HOA cited balcony repairs and unpaid fines.

Plan: Estoppel ordered day one; fines verified; credit agreed on ALTA.

Outcome: Clean transfer. Buyer accepted responsibility for post-close work.

Get a written as-is offer in 24 hours, a simple net sheet, and a closing timeline you control—without gimmicks.

Often 7–14 days after clear title. HOA/municipal requirements, estate issues, and payoff verifications can add time. We publish a milestone calendar on day one so you can plan with confidence.

Common documents include the ALTA/settlement statement, deed, wire instructions (verified by phone), and 1099-S. If you’re staying briefly after close, there’s a post-occupancy addendum that sets dates and expectations.

Not with a true as-is cash offer—repairs are priced into the number. Traditional financed deals may request repairs or credits after inspection, which can change your net and timeline.

Only if the buyer is using financing. Cash buyers may use internal valuation and skip the appraisal, removing one of the most common deal killers.

No. We’re not a law or tax firm. We provide clear numbers and process guidance so your professional’s advice is faster and more affordable to obtain.

Yes. We respect leases and local law. We can keep tenants, line up closing with notice periods, or negotiate voluntary relocation assistance where appropriate.

Want your timeline and net sheet pre-built for your address? Required fields marked *

Get a written as-is offer in 24 hours, a clear net sheet, and a timeline you control.

Explore the indices and pricing rails powering Local Home Buyers USA. We don’t guess. We model — then expose the math for sellers, partners, and regulators.

How our indices come together into a single, seller-facing offer with transparent line-items and guardrails.

Measures local absorption and buyer intensity to inform timelines and pricing power.

Quantifies the value unlocked by a Novation partnership relative to an as-is cash sale.

Estimates real-world hurdles to closing (ID, title, occupancy) and shows how tasks lower risk.

Composite execution-risk score that drives the transparent Certainty Adjustment in every offer.

Signals clarity of comps, HOA disclosures, and public data—improving expectations and timelines.

Macro-local health: employment, permits, inflation, delinquencies—expressed as a stability score.

Implementation notes and lead-gen calculator patterns for deploying FOS in production.

Models expected value from targeted repairs vs timeline risk under Novation or cash.

How time-to-close and execution risk translate into a fair, transparent adjustment.

Captures block-level sentiment and uncertainty that drive list-to-close variance.

Datasets, sources, and licensing (CC BY 4.0) for transparency and reproducibility.