Why the Inspection Contingency Matters for Sellers

The inspection contingency is the buyer’s chance to investigate property condition and either proceed, renegotiate, or walk. For sellers, that means this phase is where your pricing power and timelines either hold firm or start leaking. A clean, well-managed response can keep your closing on track while limiting unnecessary credits or repairs.

A disciplined approach starts by classifying requests into three lanes: Normal (reasonable health/safety and core system issues), Not (non-material, preference-based asks), and Push Back (overreach, double-dipping, or items disclosed/visible at offer time).

What’s Normal to Fix — and Why

“Normal” doesn’t mean “automatic.” It means the request aligns with standard expectations for habitability, safety, and functional performance. These items typically have a clear defect, a reasonable remedy, and a measurable buyer risk if ignored.

Health & Safety

- Live electrical hazards: open junctions, double-taps without rated hardware, missing GFCI where required.

- Active roof leaks or soft decking indicating water intrusion.

- Gas leaks, compromised flues, or inoperable CO/smoke detectors.

- Documented mold/moisture intrusion in habitable areas.

Major Systems & Structure

- HVAC inoperable under typical test conditions (e.g., won’t cool/heat at spec).

- Water heater at end-of-life and failing (e.g., leaking tank, unsafe T&P discharge).

- Foundation movement with engineer-verified structural significance.

- Main drain line root intrusion or collapse confirmed by scope.

What’s Not Normal — Scope Creep to Watch

These are the asks that are often nice-to-have rather than need-to-have. They rarely impact habitability or core systems and can be handled as part of the buyer’s routine ownership and personalization after closing.

- Cosmetic upgrades: new countertops, flooring color changes, cabinet refacing.

- Age alone (without failure): “Replace the 10-year-old furnace because it’s old.”

- Superficial hairline settlement cracks with no structural significance.

- Minor code updates not required at resale (unless tied to safety/function).

- Requests to replace serviceable but older appliances purely for modernization.

When (and How) to Push Back

Push back when requests expand beyond material defects, or where the buyer seeks price reduction + repair credit + concession for the same item. You’re not obligated to remodel the home; you’re obligated to deliver what you represented.

Push-back triggers

- Items disclosed or visible at showings and already priced into the offer.

- Contract asks that contradict the agreed property condition (e.g., “as-is” with right to terminate).

- Requests that exceed the scope of typical safety/functional repairs.

- Demands to use specific high-end contractors or premium materials when standard grade suffices.

Your leverage grows with documentation: licensed estimates, engineer letters, and a seller-paid re-inspection summary attach professionalism to your stance.

Interactive Lab: Inspection Strategy Generator

Turn a messy inspection report into a clear negotiation plan. Use this lab to map your timeline, condition, and repair list into a concrete stance: fix, credit, or push back.

Start on the left with your situation and what the inspector flagged. We’ll score the pressure, summarize your lane mix, and suggest which script to lead with.

1) Your Situation

2) What did the inspector flag?

3) Strategy Snapshot

Use this as a thinking tool. Final decisions should factor in local law, your agent, and your own risk tolerance.

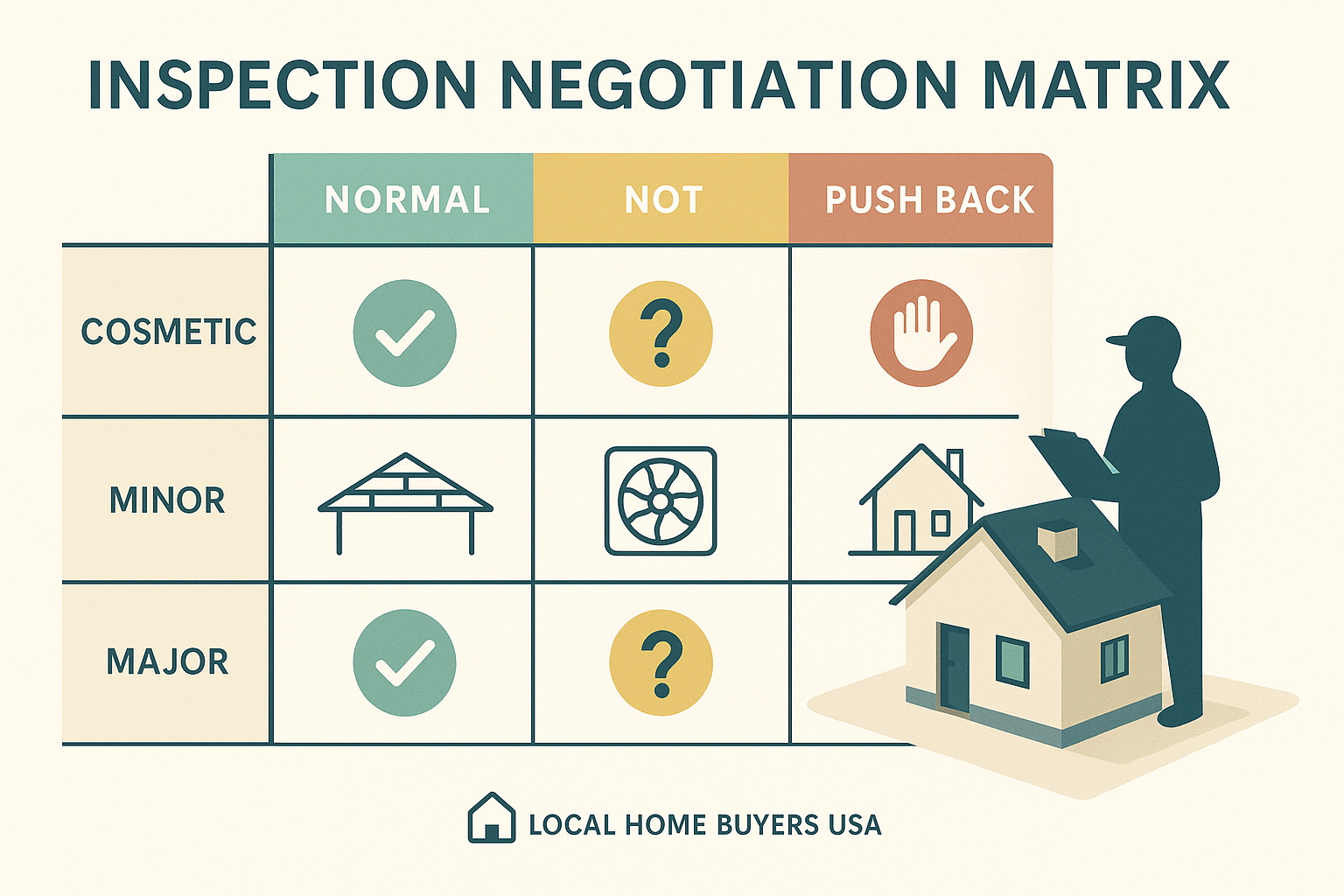

Seller’s Matrix: Health/Safety • Systems • Cosmetics

Use this three-lane framework to triage every request, keep negotiations focused, and protect your net. Start with category, then decide: Fix, Credit, Monitor, or Reject.

| Category | Examples | Typical Seller Response | Evidence That Wins |

|---|---|---|---|

| Health & Safety | Live electrical hazards, active leaks, gas leaks, missing detectors | Fix or credit; keep scope tight and code-compliant | Licensed contractor estimate, re-inspection report |

| Systems | HVAC not performing, failing water heater, main drain issues | Repair functional failure; resist “replace due to age” | Performance test, camera scope video, manufacturer spec |

| Cosmetics | Paint color, minor dings, dated finishes | Typically decline or offer token credit if strategic | “Serviceable as-is” photos, pre-listing disclosures |

Negotiation Scripts & Email Templates (Seller-Ready)

1) The “Fix Safety, Decline Cosmetics” Reply

Subject: Inspection Response – [Property Address]

Thanks for sharing the report. We appreciate the buyer’s diligence.

We’re moving forward with licensed repairs addressing safety and function:

• Correct GFCI protection at kitchen and bath circuits.

• Replace failed T&P valve discharge on water heater.

• Repair active roof leak at front dormer and replace damaged decking.

Other requests appear cosmetic or due to age but currently functional. We’ll keep those as-is.

We can provide paid invoices and welcome a re-inspection to confirm completion.

Thanks again,

[Seller / Listing Agent]2) The “Credit Instead of Coordination” Reply

Subject: Inspection Credit Proposal – [Address]

To streamline closing and avoid scheduling delays, we propose a $2,250 credit at closing

in lieu of coordinating multiple vendors. The credit corresponds to attached licensed estimates

for the items identified in the inspection summary.

Please confirm so we can keep the appraisal and closing timeline on track.

Best,

[Seller / Listing Agent]3) The “Push Back with Evidence” Reply

Subject: Inspection Response – Clarifications Attached

We reviewed the asks against the inspection report and the disclosures provided prior to offer.

• Items X and Y were disclosed and considered in pricing.

• The furnace, while older, is presently serviceable (see attached performance test).

• Countertop replacement is cosmetic and beyond customary inspection scope.

Given the above, we decline those requests. We'll proceed with the safety items already listed.

Respectfully,

[Seller / Listing Agent]Our 2025 Seller Dataset: Top Inspection Deal-Breakers

We analyzed a cross-section of seller-side transactions handled by Local Home Buyers USA (2024–2025). The table below summarizes the most common issues that trigger re-negotiation risk. Use it to prioritize pre-listing fixes and your response strategy.

| Issue Category | Most Frequent Triggers | Re-Negotiation Likelihood | Preferred Seller Remedy | Notes |

|---|---|---|---|---|

| Roof & Moisture | Active leak, soft decking, failed flashing | High | Targeted repair w/ invoice | Re-inspection recommended to close loop |

| Electrical | GFCI missing, exposed splices, double-taps | High | Licensed repair; photo proof | Fast, low dollar, high impact |

| Plumbing/Drain | Main line root intrusion, slow drains | Medium-High | Scope + spot repair or credit | Video scope removes ambiguity |

| HVAC | Cooling/heating not at spec, deferred service | Medium | Tune-up or specific component fix | Age ≠ failure; document performance |

| Foundation | Cracks/settlement, uneven floors | Medium-High | Engineer opinion; repair if structural | Evidence beats opinion |

| Cosmetics | Paint, scuffs, dated finishes | Low | Typically decline | Avoid double-counting with list price |

Methodology: Internal LHBU sample of seller-side deals (Q3-2024–Q4-2025), anonymized. “Likelihood” scores are directional, based on frequency of re-negotiation attempt in our sample and independent investor partner feedback.

Explainer Video: 2-Minute Walkthrough

In this quick walkthrough, we demonstrate how to sort inspection items into the three lanes, draft a one-page seller response, and decide between repairs vs. credit vs. firm “no.”

Related Seller Resources (Internal Links)

- Pre-Closing Checklist for Sellers

- Behind on Property Taxes? Stop Liens

- 2026 Housing Crossroads: Inflation & AI

- Coastal Flood Map Updates & Selling

- Landlord Exit Calculator (2026)

- Creative Equity: BRRRR, Subject-To, Wraps

- Quitclaim vs. Warranty Deed

- Cash Offer vs. Assumable Loan

- Mortgage Spread Watch

- NAR Settlement: New Normal

- Zillow vs. Reality: Valuations

- Senior Sellers Playbook

Inspection Contingency FAQ (Seller-Focused)

How long do buyers usually have for inspections?

Common windows are 5–10 days in many markets, but it’s negotiable. Shorter windows favor sellers and keep momentum.

Should I fix everything the report lists?

No. Focus on health/safety and true functional failures. Offer credits when coordinating multiple vendors would risk timeline.

What if the buyer asks for upgrades?

Upgrades and cosmetic preferences are “Not.” Decline politely or offer a small, round credit only if it expedites closing.

How do I prove a system is serviceable if it’s old?

Provide performance test results, maintenance records, and a licensed opinion. Age alone isn’t a failure.

Can I switch from repairs to a credit later?

Yes, if both parties agree in writing. Credits are often cleaner for scheduling and appraisal timing.