What You’ll Do in the Timeline Lab

This isn’t theory. It’s a cockpit. Use the controls, watch your flight path reshape, and then ask us for a clean written timeline and net sheet for your address.

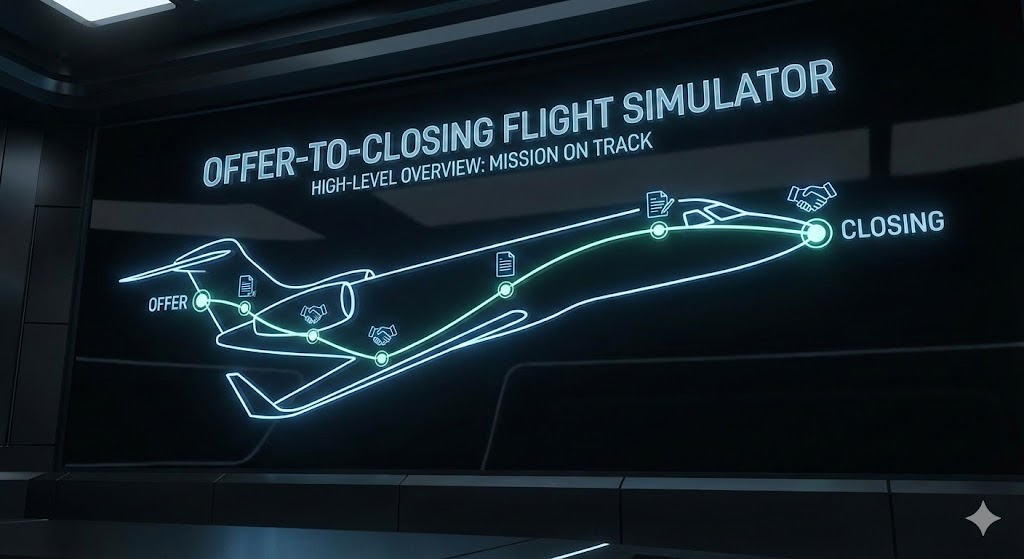

Offer-to-Closing Flight Simulator

Choose your deal type, flip on HOA/COA, probate, and city requirements, then watch your path from Offer Accepted → Clear to Close → Funding reshape in real time.

This lab is a visual model, not a guarantee. Every state, HOA, title company, and lender works differently. Use this as an orientation tool, then ask us for a written timeline tied to your real file.

You’re on a smooth route. Keep it that way by opening title quickly and confirming wire instructions directly with your closer.

For your current settings, we’d treat a clean cash, as-is offer as the control route. If you haven’t already, ask us to map this into a written timeline and net sheet for your specific address.

How the Lab Calculates Your Route

Baseline: Cash vs Financed

Every route starts with a simple baseline. In many markets, a clean cash closing on an as-is property can be aimed at roughly 7–14 days after clear title. A financed route often stretches into the 25–35 day range once you stack appraisal, underwriting, and potential repair credits.

- Cash path: fewer dependencies, no appraisal, repairs priced up front.

- Financed path: lender conditions, appraisal risk, and more re-trade opportunities.

- Either way: title, HOA/COA, and municipal requirements still matter.

Friction Dials: HOA, Probate, City, Surprises

Each toggle adds realistic friction to your route. The lab doesn’t predict the future—it reflects common patterns:

- HOA / COA: Estoppels, violations, and transfer packages can add several days.

- Estate / Probate: Extra title review and signature authority steps introduce lag.

- Municipal: City certs, point-of-sale inspections, or lien letters add processing time.

- Surprises: Old liens, changing payoffs, or last-minute addendums can snowball delays.

The point is not to scare you—it’s to see the stack. Once you see it, we can help compress what’s compressible.

Cash vs Financed: Timeline Tradeoffs in Plain English

Sticker price matters—but for real-life sellers, time and certainty can be just as valuable as an extra few thousand dollars on paper.

| Step | Financed Route | Cash + As-Is Route |

|---|---|---|

| Offer Accepted | Earnest money, lender disclosures, appraisal ordered. | Earnest money, open title, set calendar in one call. |

| Title & Payoffs | Running parallel to underwriting, subject to lender conditions. | Laser-focused on clean title, HOA/COA, and municipal items. |

| Inspection / Appraisal | Can trigger repairs, credits, or re-trades under time pressure. | Repairs are priced into the offer up front; no appraisal required. |

| Clear to Close | Depends on underwriting conditions, appraisal, and repairs. | Depends primarily on title, payoffs, and any HOA/municipal items. |

| Signing & Funding | Scheduling can slip if prior steps ran late. | Frequently scheduled once title is clear and logistics are locked. |

In the lab, the fastest route usually shows as cash + as-is + early title. In the real world, that route still needs a professional title/escrow team and clean wiring procedures—both of which we use on every file.

Common Bottlenecks (and How to Clear Them)

If your lab result keeps drifting into “heavy turbulence,” the culprit is usually one of four things.

1. Title & Old Liens

Old mortgages, home equity lines, judgments, or abstracted liens can stall “clear to close” at the worst possible time.

- Fix: share loan numbers and any payoff letters on day one.

- Fix: tell title about divorces, estates, and prior refinances.

2. HOA / COA Packages

Many communities require resale packages, violation searches, or transfer approvals. Those offices do not move faster just because your buyer is in a hurry.

- Fix: order HOA/COA docs as soon as the file opens.

- Fix: confirm who pays transfer fees and how they’re scheduled.

3. City / Municipal Requirements

Some cities require point-of-sale inspections, occupancy certificates, or special lien letters before you can transfer title.

- Fix: ask your title company which municipal steps apply.

- Fix: schedule any required inspection or cert immediately.

4. Communication Bottlenecks

Even good files stall when nobody owns the next step. That’s why we like written milestone calendars with names next to them.

- Fix: put “who does what when” into one email everyone sees.

- Fix: confirm wire instructions by phone with title only.

Send Me a Clean, Written Timeline & Net Sheet

Liked the flight simulator? Now let’s talk about your actual file. Share a few details and we’ll reply with a clear, written timeline estimate and a simple net sheet you can compare to any other path.

FAQ: Closing Time, HOAs, and Delays

Speed

How fast can a cash closing really happen?

In many markets, a clean cash file with clear title and minimal HOA/municipal friction can target roughly 7–14 days after title is open. Estate, HOA/COA, or city items can add days. That’s why we like to open title quickly and order anything time-sensitive on day one.

Comparison

How does this compare to a financed buyer?

Financed routes often land in the 25–35 day range—or longer—once you factor in inspection, appraisal, underwriting conditions, and potential repair credits. Cash removes appraisal risk and most lender-driven delays, but title, HOA/COA, and municipal requirements still matter.

Risk

What slows closings down the most?

The big three are: title surprises (old liens, unknown loans), HOA/COA timelines, and city/municipal requirements. A fourth category is communication breakdown when nobody owns the next step. We treat these as known variables and coordinate with title/escrow to clear them early.

Safety

Is this legal or tax advice?

No. This lab and its visuals are for education and orientation only. We’re not a law firm or tax advisor. Use this page to ask better questions, then combine our written timeline/net sheet with guidance from qualified local professionals.