PROPTECH RESEARCH · CREATIVE EQUITY · 2025–2026

Creative Equity on Ugly Houses: BRRRR, Subject-To & Wraps Explained — Risk Controls

A practitioner’s field guide to buying problem properties with modern creative structures. We break down BRRRR, Subject-To the existing mortgage, and Wraparound mortgages with diagrams, deal math, and risk controls designed to protect sellers, buyers, and capital.

Illustrative “dashboard” only. Use local data, counsel, and underwriting — not a blog — for actual investment decisions.

Interactive Console: Pick Your Structure, See the Trade-Offs

Use this console like a Bloomberg tile for creative deals. Tell it what matters most — speed, long-term cashflow, or simplicity — and it will highlight where BRRRR, Subject-To, or a Wrap tends to shine, along with the specific risk controls that move files from “clever” to “institutional-grade.”

Educational only. Always run final structures, disclosures, and documents through a competent real estate attorney, RMLO (where required), and CPA in your state.

Moderate urgency — enough time for rehab + refi if you stay on schedule.

Want a second opinion on whether to hold or exit? Run your actual numbers through the Landlord Exit Calculator (2026) and compare “net on time,” not just headline profit.

Creative Equity, Defined (and When to Use It)

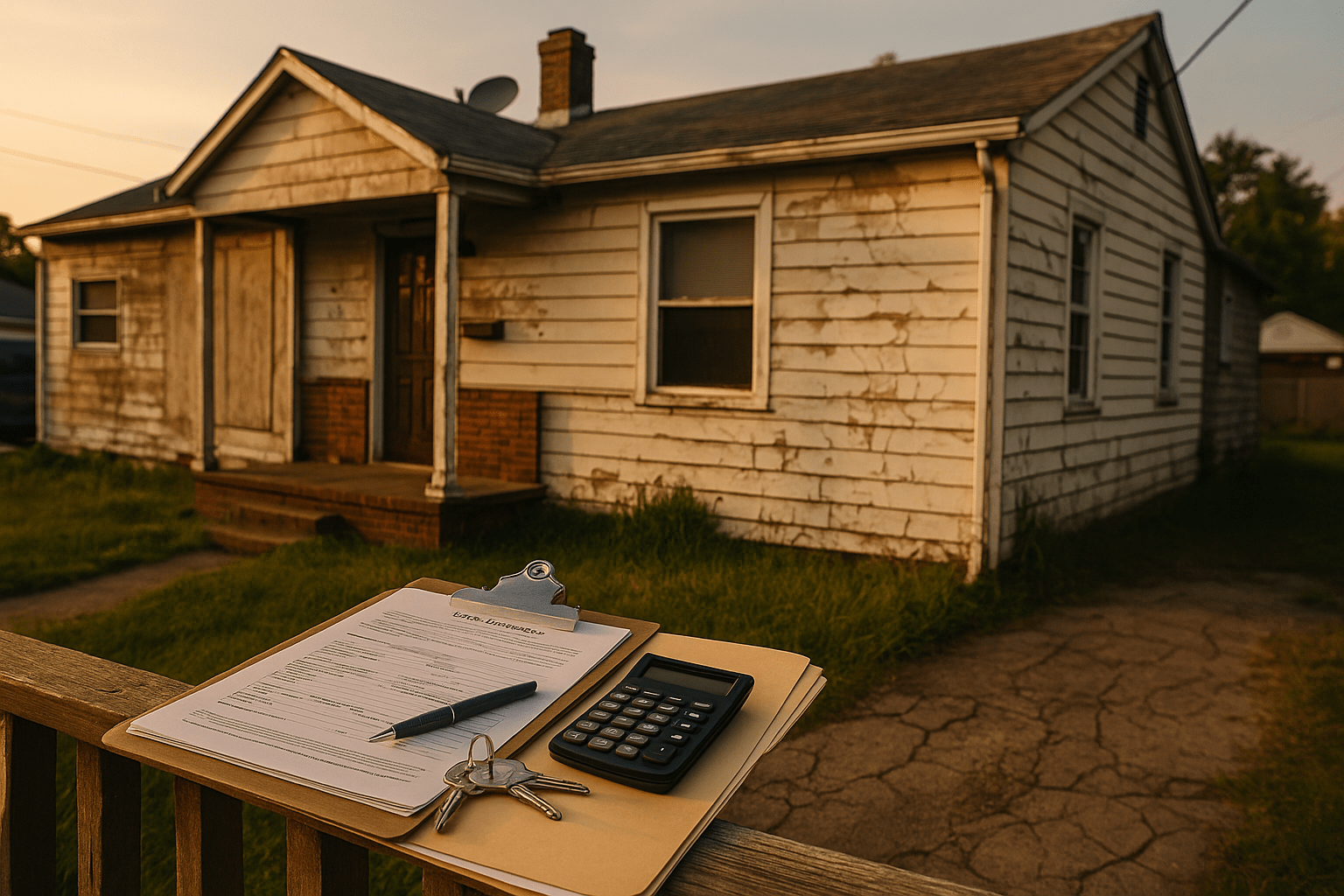

Creative equity is the family of structures used when a property is valuable but the file is clogged with friction: arrears, repairs, insurance issues, title noise, tenant problems, or a rate structure that makes traditional financing clunky. On cosmetically tired or “ugly” houses, speed and certainty often preserve more net per day than chasing a perfect top-line number that collapses in underwriting.

Used correctly, these tools can be transparent and seller-friendly. Used poorly, they create confusion and trigger lender remedies. This guide keeps you on the documented, consumer-respectful path and gives you the math, checklists, and references to stay organized.

Macro backdrop matters. Track inventory, pricing, and days-on-market so you’re not swimming upstream. Start with: 2026 Housing Outlook (inventory, prices, DOM) , the Housing Equity Map , and Inside the Title Company: How Funds Move Safely .

Quick Compare: BRRRR vs. Subject-To vs. Wraps

| Structure | Core idea | Speed | Main risks | Best fit |

|---|---|---|---|---|

| BRRRR (Buy, Rehab, Rent, Refinance, Repeat) | Force equity via rehab, stabilize with rent, then refinance and recycle capital. | Moderate | Rehab scope/overruns, appraisal risk, DSCR at refi. | Rental-grade areas, durable rent demand, clear title. |

| Subject-To (existing mortgage stays in place) | Buyer takes title and agrees to pay seller’s existing loan (without formally assuming). | Fast | Due-on-sale acceleration, servicing discipline, insurance/title communication. | Arrears, high-rate but useful term loans, timelines needing immediate rescue. |

| Wraparound (AITD/all-inclusive) | New note “wraps” underlying loan; buyer pays wrap, seller/servicer pays underlying. | Fast–Moderate | Payment waterfall risk, disclosures, Dodd-Frank/S.A.F.E. if owner-occupant. | Rate/term arbitrage, owner-finance exits, cleaner payment records. |

Still not sure which lane fits? The “Which Strategy When?” decision trees layer your priorities — speed, net, simplicity, and risk appetite — into a clearer path.

While you compare, keep a macro dashboard handy: 2026 Outlook for absorption trends, the Housing Equity Map to gauge seller cushions, and Zillow vs. Reality (2026) as a valuation sanity check.

Compliance Ground Rules (Read This First)

- Due-on-Sale (DOS) clauses. Most modern residential mortgages include DOS language. A transfer of title can allow a lender to accelerate the loan. Many investors close subject-to without incident, but a rational posture assumes the lender may notice and keeps a Plan B: reserves, refi options, or an orderly exit.

- Dodd-Frank & S.A.F.E. Act. If you’re creating seller finance to an owner-occupant, ability-to-repay rules, RMLO licensing, and disclosure requirements may apply. Use a licensed RMLO where required and structure with counsel.

- Insurance & title reality. Policyholders and named insureds must reflect who truly has risk. Notify carriers when ownership or occupancy changes, align additional insured/loss payees correctly, and keep continuous coverage (especially on vacant houses and cold-weather markets).

- Honest, written disclosures. Representations about payment flows, who pays what, cure options, and what happens if a loan is accelerated should be on paper, initialed, and mirrored in closing instructions to the title company or attorney.

- This is education, not legal/tax advice. Final structures, documents, and tax posture belong with your real estate attorney and CPA.

Want a clear picture of money movement? Start with Inside the Title Company: How Funds Move Safely — it shows how good instructions, escrow accounting, and payoffs are supposed to work.

BRRRR with “Ugly” Houses — Step-by-Step, Risk-Aware

- Buy at a basis that survives reality. Model ARV using comps after you’ve inspected panels, roof, foundation, and mechanicals. Cross-check online values with boots-on-ground photos via Zillow vs. Reality (2026) .

- Rehab for durability, not just appraisal. In rentals, lifecycle costs win. Moisture control, ventilation, serviceable finishes, and tamper-resistant devices beat fragile counters that look good once. In cold-weather markets, align with Snowbelt Vacants .

- Rent to a standard. Target rent that supports DSCR underwriting at refi (often 1.2–1.25x or better). Document market rent with leases, deposit confirmations, and a clean ledger.

- Refinance with clean files. A good refi file reads like a small operating business: stabilized rent roll, believable ARV, and documented expenses. Use the 2026 Housing Outlook to avoid trying to refi into a stiff headwind.

- Repeat with recycled equity. Guard against scope creep; log SKUs and vendor bids. Your best hedge against overrun is a repeatable scope, reliable trades, and a punch-list culture.

BRRRR shines where rent demand is robust and rehab can be standardized. Weak points are usually capex surprises and refi timing. Hedge both with a conservative basis and live read on your submarket.

Tools to Keep BRRRR Honest

- Housing Equity Map — know how much protective equity typical sellers have.

- 2026 Outlook — time refis when absorption and appraisals are friendlier.

- Zillow vs. Reality (2026) — reality-check your ARV before you sign.

Subject-To the Existing Mortgage — How It Works, Why It’s Sensitive

Mechanics: The seller deeds the property to the buyer. The existing loan remains in the seller’s name; the buyer agrees (in a separate agreement) to make payments, taxes, insurance, and any escrowed items. No formal assumption occurs. Title transfers; debt stays.

Core Advantages

- Speed: No new lender underwriting. Useful in arrears, looming sale dates, or when repairs spook retail lending.

- Legacy terms: A below-market rate or favorable amortization schedule can be a scarce asset worth preserving.

Key Risks & Controls

- Due-on-Sale acceleration. Lender may call the note. Controls: pristine payment history via third-party loan servicing, adequate reserves, and defined Plan B options (refi, payoff, resale). Expectations should be in writing.

- Escrow discipline. Taxes and insurance must remain current. Title instructions should route proof of payment to both parties monthly.

- Insurance alignment. Keep the lender’s interest intact while reflecting the new titleholder. Work with the carrier to list additional insured/loss payee correctly, especially for vacancy.

- Reputational & consumer risk. Use transparent seller receipts, a welcome letter explaining servicing, and a dispute-resolution clause that names the closing attorney/title as neutral communicator of records.

If you haven’t yet, read Inside the Title Company: How Funds Move Safely so your instructions match your promises.

Wraparound Mortgages (AITD/All-Inclusive) — Payment Waterfalls Without Mystique

In a wrap, the buyer signs a new promissory note and deed of trust/mortgage to the seller for an amount that includes the underlying balance. The buyer pays the wrap; the seller (or servicing agent) pays the underlying loan. The wrap’s rate and term can be tuned to create a spread for the seller or solve a buyer’s qualification problem.

Why Use a Wrap?

- Cleaner accounting: One note, one servicer, auditable statements.

- Term engineering: Amortization, balloons, and rates can be tailored to your exit plan.

Regulatory Watch-Outs

- Owner-occupant buyers. When the buyer will live in the home, Dodd-Frank ability-to-repay rules and S.A.F.E. licensing may apply. Engage an RMLO and use compliant forms.

- Truth-in-Lending-style clarity. Spell out the waterfall: what comes in, what goes out, who cures deficits, and what happens if payments are missed. Tie the servicer’s instructions directly to the closing file.

Wraps are excellent when you need documentation discipline and want flexibility to resell, rent, or refinance later. Like subject-to, they require adult-level servicing.

Risk Controls that Actually Move the Needle

1) Servicing & Transparency

- Use a licensed third-party servicer to collect payments and remit to the underlying lender.

- Require monthly statements to all parties, with alerts for shortages or late payments.

- Spell out cure windows, reserves, and escalation steps in writing.

2) Title & Escrow Instructions

- List who pays arrears, next installments, and fees; spell out pro-rations.

- Record memoranda where advised by counsel to avoid surprises later.

- Align your instructions with Inside the Title Company .

3) Insurance & Vacancies

- Align named insureds and loss payees with the real economic interests.

- Use vacancy and seasonal endorsements where applicable.

- Cold markets: protect pipes and roofs — see Snowbelt Vacants .

4) Math Discipline

- Underwrite to net on time, not just theoretical top-line profit.

- Stress-test with rate and DOM scenarios using the 2026 Outlook .

- Reality-check valuations with Zillow vs. Reality (2026) .

Deal Math: Net on Time vs. Theoretical Profit

Assume a tired SFR with ARV $300k, current as-is value $215k, rehab $35k, taxes/insurance $4k per year, and market rent around $2,200. The seller is two months behind on a 5.0% fixed note at $1,250 PITI. Same property, three different lanes:

BRRRR Snapshot

- Acquire: $215k purchase + $3k arrears + $3k closing ≈ $221k basis before rehab.

- Rehab: $35k → all-in ≈ $256k.

- Refi: 70% ARV → ~$210k; 75% → ~$225k, subject to appraisal and DSCR on $2,200 rent.

Subject-To Snapshot

- Take title, reinstate arrears, resume $1,250 PITI; light $12k make-ready.

- Rent at $2,000–$2,200; cashflow spread funds reserves and capex while you season for refi or sale.

Wrap Snapshot

- New wrap note at, say, 6.5–7.5% around the 5.0% underlying.

- The spread funds your margin and reserves, provided waterfalls and cures are clearly documented.

The true hedge in all three lanes is boring: on-time payments, continuous coverage, written instructions, and a small reserve that buys options if a lender knocks on the door.

For landlords deciding whether to hold or exit, model real outcomes in the Landlord Exit Calculator (2026).

Which Strategy When? Decision Trees

If the priority is speed + arrears relief

- Subject-To if the existing note’s rate/escrow are acceptable and seller cooperation is strong.

- Wrap when you want a clean new note, servicer trail, and retail-friendly exit.

If the priority is long-term cashflow

- BRRRR in rental-friendly ZIPs where rents support DSCR post-rehab.

- Consider a wrap exit if your buyer base wants financing and you’re ATR-compliant.

Layer in market timing with the 2026 Outlook and equity buffers with the Housing Equity Map. For valuation reality checks, re-read Zillow vs. Reality.

Closing Checklists, Docs & Servicing

Documents

- Purchase & sale with addenda describing payment obligations.

- Subject-To or wrap disclosures; underlying loan summary sheet.

- Authorization to release information (loan, insurance, HOA).

- Servicing agreement + auto-draft setup.

- Insurance endorsements naming the right parties.

- Escrowed reserves for arrears, next installments, and taxes.

Operational Rhythm

- Monthly statement to all parties from the servicer.

- Quarterly escrow review for tax/insurance changes.

- Vacancy/winterization plan (see Snowbelt Vacants).

- Annual review of rent, values, and refi exits using the 2026 Outlook .

Where new investors get hurt isn’t usually the structure — it’s sloppy servicing. Use professionals. Keep receipts. Be painfully clear about “who cures what by when.”

Frequently Asked Questions

Can my lender really call a loan due if I take a house subject-to?

Yes. Due-on-sale clauses typically permit acceleration after a transfer. Many subject-to deals perform quietly, but a mature risk posture assumes detection is possible: impeccable payment history, reserves, and a defined refi/payoff path. Keep communication lines open with your closing attorney and servicer.

Is a wrap safer than subject-to?

“Safer” depends on execution. Wraps create a new note with clearer accounting, which many teams find easier to service and audit. But both structures require disclosures, servicing discipline, and — if your buyer is an owner-occupant — compliance with applicable Dodd-Frank and S.A.F.E. rules.

What insurance setup works on subject-to and wraps?

Maintain continuous coverage, align named insureds and loss payees with who truly bears risk, and notify carriers properly when ownership or occupancy changes. Vacant or winter-exposed properties need endorsements and utility plans (see Snowbelt Vacants ).

How do I avoid overpaying on an “ugly” BRRRR?

Use conservative ARV comps and run numbers against real DOM/price trends in the 2026 Outlook . Validate online estimates with Zillow vs. Reality (2026) .

Should I keep or sell after stabilizing?

Run scenarios in the Landlord Exit Calculator (2026) . Decision quality improves when you compare net per day, needed reserves, and stress-tested exit values — not just the prettiest gross spread on a whiteboard.

Watch: Local Home Buyers USA (30-Second Commercial)

Need a clean 7–14 day exit?

Get a transparent, as-is offer with documented timelines. No repairs. No showings. No surprises.