AI-Powered Valuations in 2026: What Sellers Should Trust (and Ignore)

AI valuation models now touch nearly every price conversation—from Zestimates to lender AVMs. This guide shows how to use them like a pro: what to trust, what to ignore, and how to run a clean, 10-minute reality check before you list or accept an offer.

See your AI value and a verified cash offer on one clean screen.

We blend top AVMs with local comps, repairs, and closing costs so you can see—in dollars— what selling to the open market vs. a no-repair cash buyer really nets you.

2026 AI Valuation Reality Console

Set your property profile and see where AI is strong, where humans add lift, and how that maps to a cash-backed offer.

Operational Chapters

- Why AI valuations matter this year

- How today’s models price a home

- What you can trust

- What to ignore (or discount)

- A quick input check that fixes most errors

- A simple 7-step verification plan

- Signals that confirm or contradict the number

- A/B test your list price

- Short commercial: fast, no-drama sale

- Edge cases, risks, and fairness

- FAQ

- Datasets & licenses

- Get your custom offer

1) Why AI valuations matter this year

Pricing is not just a number—it’s a plan. After the wild swings of the pandemic years, the market in 2026 is calmer but still competitive for clean, well-presented homes. That means your first number sets the tone. If it’s close, you’ll get showings, offers, and leverage. If it’s off, you’ll chase the market down, rack up days-on-market, and end up making concessions anyway.

Now, because AI estimates refresh frequently and pull data from across the web, they often become your first “compass.” That’s fine. Use them. They’re fast. They’re consistent. And they’ll give you a range that makes the rest of your decisions easier. But—like any tool—you still need to double-check the parts that can mislead you: condition, micro-location, and risk factors that a black-box model might only partially see.

2) How today’s models price a home

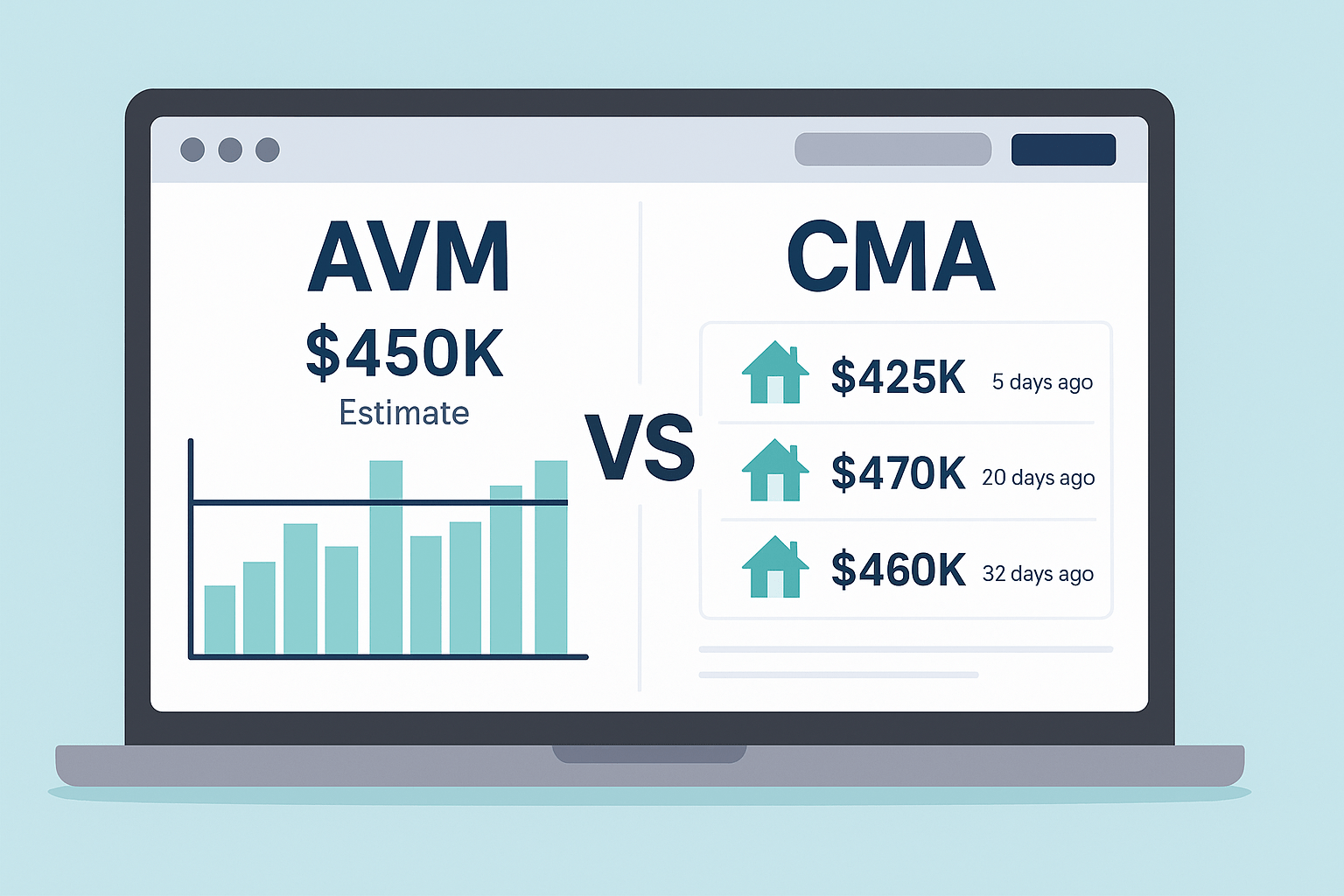

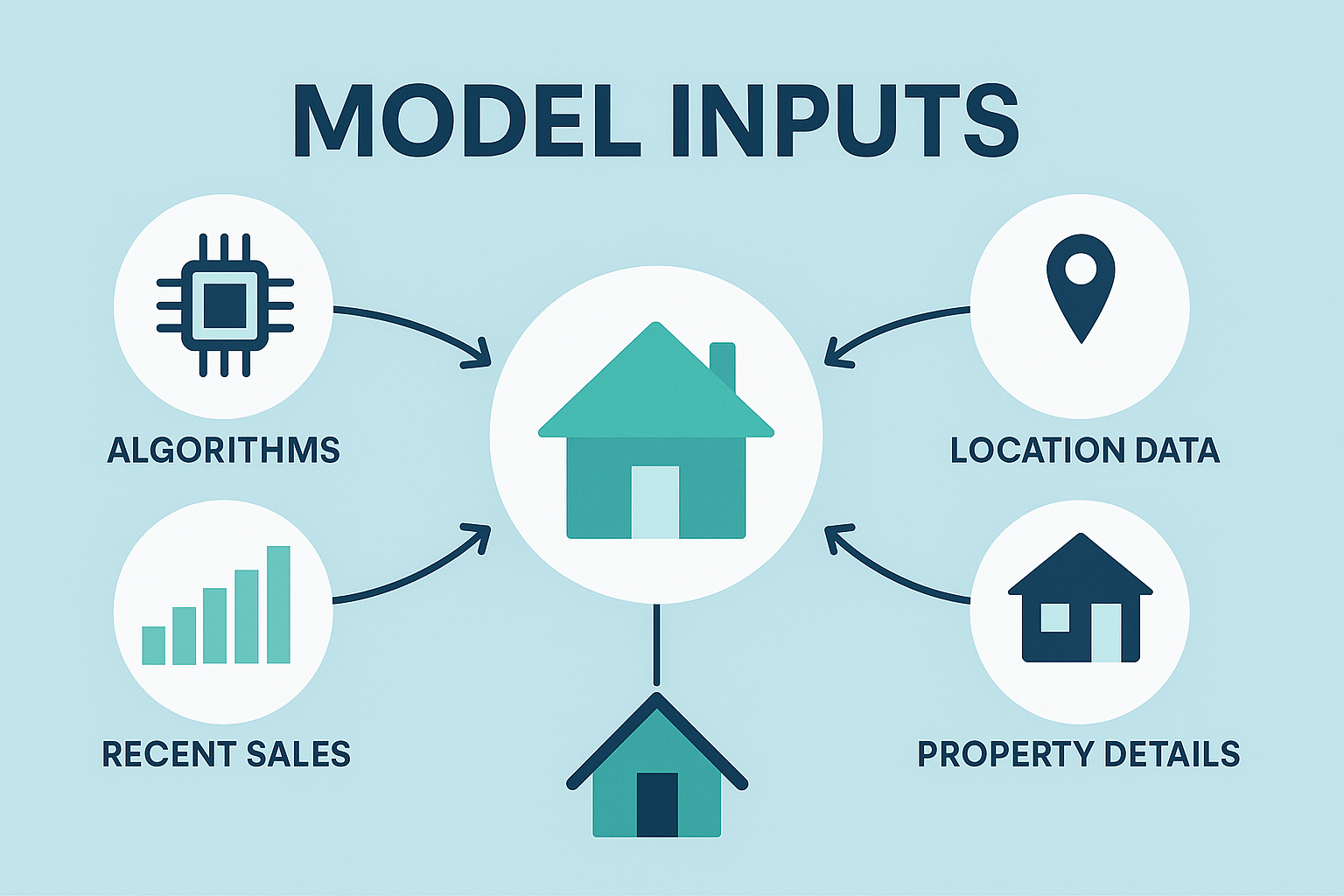

Most modern valuation systems blend traditional stats (the “hedonic” approach) with deep learning. In plain English, they look at everything they can find: bedroom count, square footage, the lot, the age, the photos, the description, nearby sales, current listings, even neighborhood patterns. Then they produce a range and put a single estimate in the middle.

A trustworthy tool shows you its confidence band and the top drivers. If you only get a single number, treat it as a rough draft, not the final say.

3) What you can trust

3.1 Direction—especially over the next 30–60 days

Because these models drink from fast-moving data streams, they’re good at calling the direction: flat, softening, or firming. If you see a softening signal and a rising share of price cuts nearby, it’s a nudge to price tight and offer cleaner terms out of the gate.

3.2 Rank within a tight comp set

If your home is similar to several recent sales—same year range, same finishes, similar lots—AI usually ranks you correctly inside that band. In that setting, the estimate is a solid starting anchor.

3.3 Time-to-sell curves

Many platforms now predict days-on-market at different price points. The exact number can be off, but the shape of the curve—“more price equals more time”—is reliable. Use it to choose a “confidence price” and then pre-commit to a day-14 check-in.

3.4 Public, verifiable context

- Mortgage rates (Freddie Mac PMMS): freddiemac.com/pmms

- Listing supply (Redfin, Realtor.com): Redfin Data Center • Realtor.com Research/Data

- Regional price trends (Zillow Research): Zillow Research/Data

4) What to ignore—or at least discount

4.1 A single number without a range

No range, no trust. Even great models have error bars, and they widen for one-of-a-kind homes, heavily remodeled properties, rural locations, or places with unique insurance rules.

4.2 Stale condition assumptions

New roof? New systems? A real kitchen overhaul? If the photos or permits don’t show it, the estimate may lag. Make the truth easy to see and your number will move where it should.

4.3 Cute comps from the wrong micro-market

This one bites a lot of sellers. A comp that looks perfect on paper might sit across a school boundary, an insurance tier, or a flood line. When that happens, the price lessons don’t travel well.

4.4 Over-relying on price per square foot

PPSF is helpful in cookie-cutter neighborhoods. But in mixed-tier areas—originals next to new builds—it blurs everything. Normalize for effective age and scope of work before PPSF steers you wrong.

5) A quick input check that fixes most errors

Transparency is your friend. When a tool shows you its inputs, you can spot the mismatch in minutes. Here’s what to scan first:

- Structure: beds, baths, GLA, lot size, garage, pool/ADU.

- Condition: renovation level, effective age, roof/HVAC/plumbing/electrical.

- Micro-location: school zone, flood/brush/wind risk, insurance category.

- Market signals: active vs. pending density, price cuts, and DOM trends.

Fast path: screenshot the inputs, circle anything off, fix it (or ask your agent/platform to), then rerun the estimate. Two cycles like this usually tighten the range.

6) A simple 7-step verification plan

- Start with two independent AVMs. Treat them as guardrails.

- Build a clean comp set (last 90–120 days). Same micro-market. Similar effective age/finish. Matching risk/insurance tier.

- Layer in actives and pendings. They price the market you’re entering now.

- Adjust like an appraiser. Big-ticket items (roof, systems) deserve real adjustments. Fresh paint usually doesn’t.

- Check affordability and seasonality. Watch PMMS weekly and note your local DOM rhythm.

- Pick your “confidence price.” Aim for a 30-day sell with high probability given absorption.

- Pre-commit to day-14 decisions. If tours and saves lag, reduce or sweeten terms (2-1 buydown, closing credit).

7) Signals that confirm—or contradict—the number

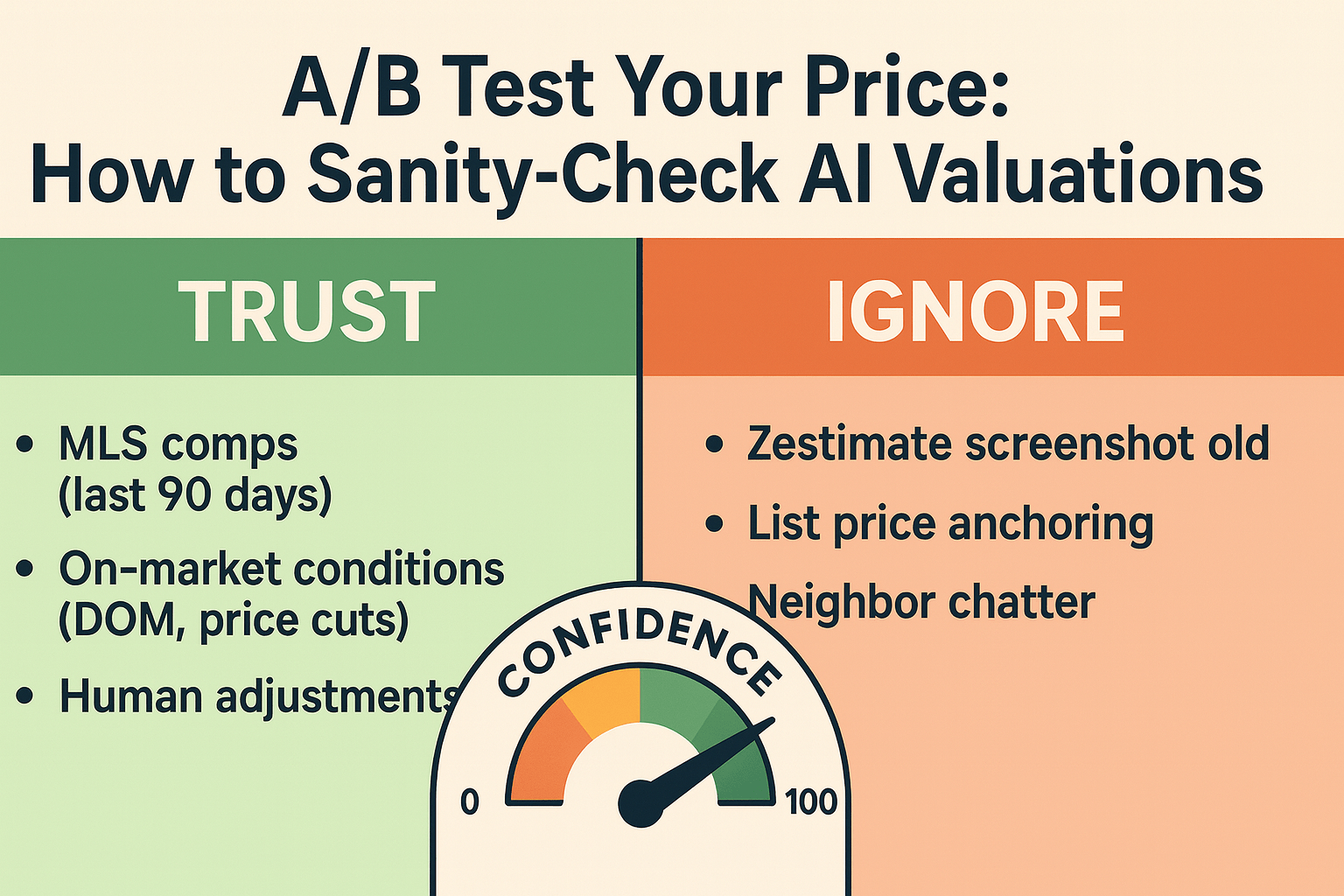

Signals that confirm

- Two AVMs cluster within ~2–3% after you correct inputs.

- Pendings within 0.3 miles and ±10% GLA match your finish level and price band.

- Showings and saves hit local benchmarks in the first 10 days.

Signals that contradict

- Nearby price cuts climb while your listing gets light traffic.

- Insurance or HOA assessments are scaring off your buyer tier.

- Similar homes two streets over go pending quickly while yours idles.

When in doubt, trust the signals tied to offers and pendings. People vote with earnest money.

8) A/B test your list price: balance speed and net

Let’s say one model lands at $420K (±3%), another at $415K (±4%), and your comp set centers near $418K. You need to move within 45 days. You have two honest options:

- Speed first: List at $414,900. Offer a pre-announced 2-1 buydown and simple inspections. Expect strong traffic fast and fewer contingencies.

- Net first: List at $424,900 with an offer deadline and a prepared appraisal-gap plan. Expect longer DOM while you test the ceiling.

In a balanced-to-cool market, many sellers win by choosing “speed first” and gaining back net through cleaner terms. The key is deciding before launch which outcome matters most, then measuring against that goal.

9) Short commercial: how a fast, no-drama sale works

Prefer a walkthrough of closing mechanics? Here’s our plain-English guide to how funds move safely at a title company.

10) Edge cases, risks, and fairness

Unique homes

Custom builds, rural estates, or properties with income-producing ADUs don’t fit neatly in standard comp grids. In these cases, your adjusted analysis (and documentation) matters more than any single AI number.

Data gaps and model drift

When photos are old, permits are slow, or insurance rules shift mid-cycle, models drift. Fresh photography, an honest upgrade list, and current insurance quotes stabilize your number and reduce renegotiation risk.

Fairness

Reputable AVMs exclude protected-class variables, but proxy biases can still creep in through neighborhood patterns. The antidote is simple: center your decisions on property traits and apples-to-apples comps. Keep it fair. Keep it clean.

The appraisal checkpoint

An AI price can attract offers, but financing depends on the appraisal. If your AVMs and comp story agree, the appraisal often does too. If not, plan for appraisal-gap strategies or prioritize cash buyers.

11) Frequently asked questions

How accurate are AI valuations in 2026?

They’re strong in neighborhoods with many recent, similar sales. Expect wider ranges for unique homes, heavy remodels, rural properties, or areas with complex insurance rules.

Should I price at the AI number?

Use it as one anchor. Verify with clean comps, live actives/pendings, and local DOM trends. Choose a “confidence price” that clears in your target window.

What if two models disagree?

Check inputs and risk layers first. Remove mismatched comps. If they still disagree, list inside the overlap and let showing data drive your day-14 adjustment.

How do rate moves change my plan?

Small drops in rates widen the buyer pool at payment-sensitive price points. Watch PMMS weekly and pair it with price-cut and DOM trends to time adjustments. See Freddie Mac PMMS.

Do cash buyers make AI less relevant?

Cash reduces appraisal risk, but pricing still matters. AVMs help you map the demand curve and choose the terms that maximize your net and certainty.

12) Datasets & licenses (fact-check hub)

- Freddie Mac PMMS: weekly mortgage rate survey — freddiemac.com/pmms

- Redfin Data Center: active/new listings, DOM, prices, pendings — redfin.com/news/data-center

- Realtor.com Research: monthly trends + data library — realtor.com/research/data

- Zillow Research: home-value dashboards and forecasts — zillow.com/research/data

- FRED (Federal Reserve Bank of St. Louis): macro series (HOUST, PERMIT, COMPUT, RHVRUSQ156N) — fred.stlouisfed.org

Public-sector publications are generally public domain; private-sector datasets typically allow reuse with attribution and linking. Always review current terms before redistributing raw series.

Get a Custom Cash Offer (No Fees, No Repairs)

We buy houses across 16+ states. Answer a few quick questions—no obligation. Prefer to talk? Call us via the number on our How it Works page.

Editorial standards (E-E-A-T)

Experience: We price homes across multiple states and insurance regimes every week. Expertise: We pair AVMs with appraiser-style adjustments and live listing signals. Authoritativeness: We cite primary datasets from Freddie Mac, Redfin, Realtor.com, Zillow Research, and FRED. Trustworthiness: We publish ranges, show our work, and pre-commit to review checkpoints so you can decide with confidence.

Real-World Seller Insights

Fresh how-tos and market tips from Local Home Buyers USA.