Quitclaim vs Warranty Deed: When Each Makes Sense (Seller’s Guide, 2026)

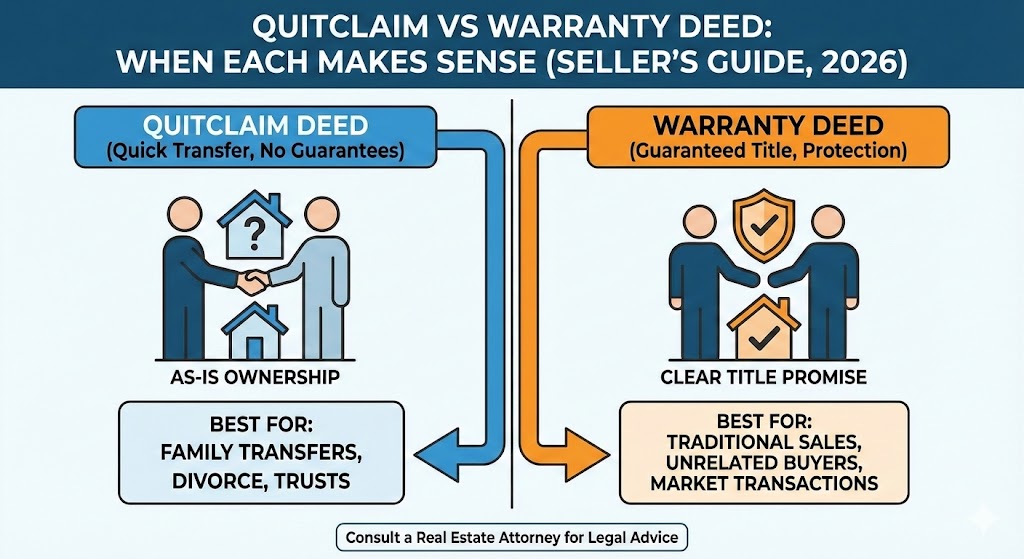

A quitclaim deed transfers whatever interest the grantor has—with no guarantees about title. A warranty deed conveys title with enforceable warranties. In arms-length sales, warranty deeds (with title insurance) are standard; quitclaim fits intra-family transfers, divorce, estate clean-ups, and minor cloud fixes—ideally with local title and legal guidance. We coordinate closings in all 50 states.

Deed Strategy Console (Beta)

Answer a few questions and this console will model which path is likely better aligned with industry practice— quitclaim, warranty deed, or a “clean up then sell” hybrid. This is education only, not state-specific legal advice.

Likely baseline: Warranty deed with title insurance

Because this looks like an arms-length sale—and you mentioned lender or price-maximizing goals—the market-standard path is a state-specific warranty deed plus lender & owner title policies. Quitclaim is generally not used as the primary conveyance here.

Elevated: quitclaim shifts title risk toward the buyer and may block lender approval.

Checklist from this console

- Loop in a reputable title/escrow company early to run a full title search.

- Use the correct state-specific warranty deed form (general/limited) plus required affidavits.

- Confirm lender requirements and make sure owner’s and lender’s title policies are issued.

- Retain your recorded deed and policy packets after closing for future transfers and estate planning.

Want a human to walk this with you? We’ll map your deed path and coordinate an insured closing anywhere in the U.S.

Request my deed strategy callPlain-English: Quitclaim vs Warranty Deed

Quitclaim deed: transfers whatever interest the grantor currently has in the property, if any, without warranties about the quality of title. There are no covenants about liens, encumbrances, or even full ownership.

Warranty deed: conveys title with enforceable covenants (seisin, right to convey, against encumbrances, quiet enjoyment, warranty/defense). Variants include general warranty (covers the entire chain) and limited/special warranty (grantor’s ownership period only).

Definitions: Cornell Law’s Wex entries on quitclaim deed and warranty deed.

Protections & Risks (Side-by-Side)

| Topic | Quitclaim deed | Warranty deed (general/limited) |

|---|---|---|

| Promises about title | None. Transfers whatever interest the grantor may have. | Yes—seisin, right to convey, against encumbrances, quiet enjoyment, warranty/defense. |

| Buyer protection | Low—buyer bears title risk; often not lender-acceptable. | High—enforceable promises; lender-standard with title insurance. |

| Common uses | Family transfers, divorce, adding/removing spouse, estate clean-up, correcting errors, clearing minor clouds. | Arms-length sales to third parties, financed purchases, most standard retail closings. |

| Title insurance | Recommended; some underwriters scrutinize quitclaim-based deals more closely. | Standard—lender’s policy required; owner’s policy strongly recommended. |

| Recording & taxes | Record with county; transfer/documentary taxes/forms vary by state/county. | Same; plus customary affidavits/disclosures for insured retail closings. |

| Financing impact | Lenders often refuse to fund based on quitclaim alone. | Meets lender expectations alongside title insurance and closing protections. |

When a Quitclaim Is Reasonable (and When It Isn’t)

Reasonable scenarios

- Family/estate planning: into/out of a revocable trust, between spouses, probate distributions.

- Divorce decree: one spouse conveys interest to the other per court order.

- Record corrections: name changes, scrivener’s errors (with title guidance).

- Minor cloud resolution: a party releases potential interest to clear title for a separate insured conveyance.

Use caution

- Arms-length sales: buyers expect warranties + insurance; use a warranty deed.

- Unknown liens/heirs: quitclaim offers no protection; rely on title search/insurance.

- Due-on-sale risk: some transfers can trigger mortgage clauses. See CFPB’s Owning a Home.

Owner’s & Lender’s Policies

Title insurance protects against covered defects (e.g., undisclosed liens, forged prior deeds, recording errors). Lenders typically require a lender’s policy; buyers commonly purchase an owner’s policy. See ALTA’s consumer hub: alta.org/consumer.

Recording the deed

Recording with the county provides public notice and preserves priority. Fees, transfer taxes, and forms vary by state/county—check your recorder or register of deeds on an official .gov site.

Liens, Payoffs & Wire Safety

Mortgages, mechanics’ liens, HOA liens, judgments, and tax liens can survive if not paid or released. Title/escrow pulls payoffs and records releases at or after closing. For a deeper look at safeguards, see Inside a Title Company: How Funds Move Safely.

Wire safety: Confirm payoff and wire instructions directly with the title company via known phone numbers. (FBI IC3 reports persistent real-estate wire fraud.)

Gifts, Consideration & Tax Notes

Quitclaims are common in gifts or nominal-consideration transfers. Federal gift-tax rules may apply; see the IRS overview of the Federal Gift Tax. Property-tax reassessment and transfer-tax rules are state/county-specific.

Informational only—consult a licensed professional in your state or your local legal-aid office (USA.gov directory).

Step-by-Step Checklist

- Define the deal: family/estate update vs. arms-length sale (the latter = warranty deed).

- Engage title/escrow early: run a title search; gather payoff, HOA, tax status.

- Select the deed form: state-specific warranty (general/limited) or quitclaim + required affidavits/tax forms.

- Execute correctly: notarization; witnesses (in some states); exact legal description.

- Record & insure: title/escrow records, disburses, and issues policies as applicable.

- After closing: retain recorded deed & policy; update insurance, mailing address, estate plan.

Need clarity on which deed to use?

Get straight, local guidance and see your net numbers side-by-side—cash today vs. traditional listing. No pressure.

We close through licensed title companies/attorneys nationwide.

Watch: How a Fast, Insured Closing Works

Related Guides

Datasets & Licenses

- Cornell Law — LII/Wex: Quitclaim deed • Warranty deed. License: LII Terms of Use.

- American Land Title Association (ALTA): Consumer title guides. License: Site terms (attribution).

- Consumer Financial Protection Bureau (CFPB): Owning a Home. License: U.S. government work (public domain).

- Internal Revenue Service (IRS): Gift Tax overview. License: U.S. government work (public domain).

- USA.gov: Legal-aid directory. License: U.S. government work (public domain).

State recording rules differ; consult your county recorder or a local attorney.

Experience, Expertise, Authoritativeness, Trustworthiness

Experience: We coordinate deeded transactions across all 50 states with licensed title/attorney partners. Expertise: Definitions from Cornell LII, industry practice via ALTA, and federal consumer guidance (CFPB, IRS). Authoritativeness: Direct links to primary sources and government sites. Trustworthiness: Clear scope—general education, not state-specific legal advice.