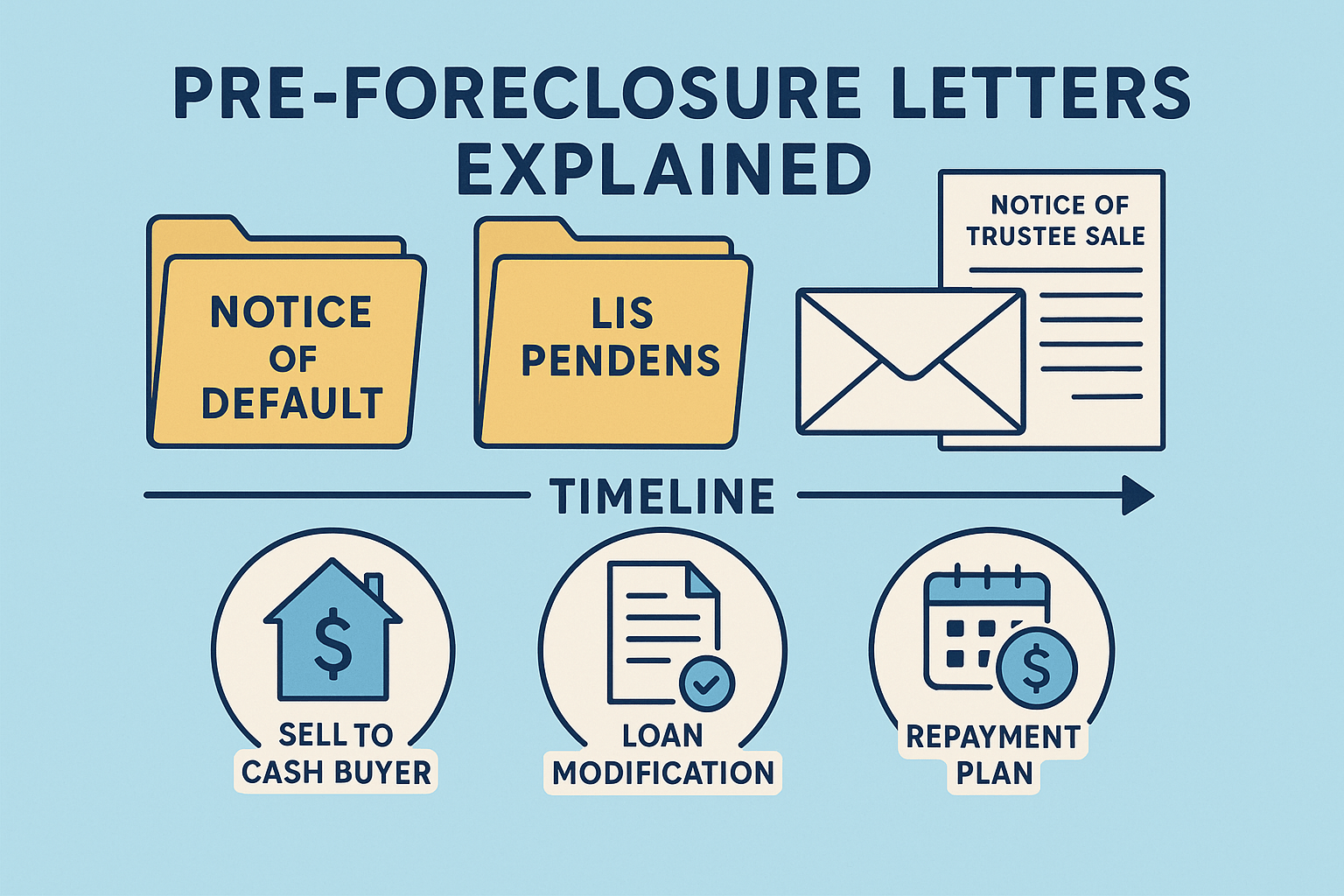

Pre-Foreclosure Letters Explained: What Each Notice Means & Your Options (2026)

When a bold envelope lands, fear spikes—and the clock starts. This guide decodes every letter you’ll see (Breach/Demand, Notice of Default or Lis Pendens, Acceleration, and Sale Notice), clarifies your rights & timelines, and lays out practical paths to keep or sell your home—safely and fast.

Get a Cash Offer (7–21 Days)

TL;DR: Open, date, decide. You have more power than the envelope suggests.

- Breach/Demand = cure window (often 30+ days) before acceleration.

- NOD/Lis Pendens = public pre-foreclosure starts; the sale clock begins (state-specific).

- Sale Notice = an auction date exists—but reinstatement, loan mod, or a signed sales contract can still change outcomes.

- Fast exits: on-market listing (time/repairs) or as-is cash (7–21 days). Start here.

- Safety: verify wires by phone (known number), beware paid “rescue” schemes, use HUD-approved counseling.

LIVE: Pre-Foreclosure Decision Console

Use this console to translate “stress” into a plan. Slide days behind, choose your state process, toggle what’s true for you, and the console will estimate stage, sale risk, and your next three moves. Then compare it to a 7–21 day as-is sale.

1) Where are you in the process?

Roughly how far behind are you, and is there a sale date yet?

- Call your servicer using the number on your statement and request a written reinstatement quote.

- Confirm any sale date with the trustee/court website and mark key countdown dates.

- Get a HUD counselor + as-is cash offer lined up so you can compare keep vs. sell.

1) Every Pre-Foreclosure Letter, Decoded

Late/Delinquency Notice

Arrives after a missed payment. Lists past-due amount/fees and invites you to contact the servicer’s loss-mitigation team. Early calls save money; legal fees mount over time.

Breach / Demand (“Right to Cure”)

Formally cites default and provides a cure deadline (often 30+ days) to reinstate. Miss it, and the lender may accelerate the balance. Get a written reinstatement quote now.

Notice of Default (NOD)

In non-judicial states, a trustee records a NOD after cure expires. This starts the public countdown to a sale notice.

Lis Pendens (Judicial States)

Signals a foreclosure lawsuit. You’ll be served a complaint; you can answer, mediate, or pursue loss-mitigation. Courts move slower—but fees accrue.

Acceleration Letter

Demands the full loan balance. Options can still include reinstatement, mod, sale, or legal remedies—ask the servicer what remains.

Notice of Trustee Sale / Sale Notice

Sets an auction date. You can still reinstate by the state-specific cutoff, or submit a signed sales contract to request a postponement.

2) Rights & Timelines (Know Your Levers)

| Right/Protection | What It Means | Where to Confirm |

|---|---|---|

| Right to Reinstate | Pay arrears + fees to restore the loan up to a deadline (varies by state/contract). | Servicer/trustee; state statutes; CFPB |

| Loss-Mitigation Review | If you submit a complete app on time, servicers generally must evaluate; sales can be paused during review. | Servicer policies; Regulations |

| Notification Rules | Mailing/recording/posting standards must be followed; errors can be defenses—see counsel. | State law; trustee notices |

| Redemption (post-sale) | Some states allow a window to reclaim the property after sale. | State statutes / local attorney |

3) Keep vs. Sell: Which Option Wins in 2026?

Keep the Home

- Reinstate quickly if cash is available; cheapest reset.

- Repayment Plan spreads arrears across future payments.

- Forbearance pauses/reduces payments for a time.

- Loan Mod changes terms/rate; requires full documentation & stable income.

Exit on Your Terms

- List on MLS for max exposure (needs time/condition).

- As-Is Cash for speed (often 7–21 days) and certainty.

- Short Sale if underwater; servicer approves lower payoff.

- Deed-in-Lieu avoids auction; often requires vacancy/clear title.

| Path | Speed | Paperwork | Repairs/Showings | Works Best When… |

|---|---|---|---|---|

| Loan Mod | 30–90+ days | High | None | Income stabilized, time before sale |

| MLS Listing | 30–90+ days | Medium | Often yes | Good condition, time to market |

| Cash Sale | 7–21 days | Low | No | Need certainty/repairs/time crunch |

| Short Sale | 45–90+ days | High | Maybe | Underwater with hardship |

Within 30 days of sale? A signed contract + proof of funds can support a trustee postponement. We do this routinely. Get Offer.

4) Myths vs. Facts

Myth:

“Once I get a sale notice, nothing can stop it.”

Fact:

Reinstatement, approved loss-mit, or a bona fide sale contract often pauses/postpones sales, depending on timing and state rules (CFPB).

Myth:

“I must move out now.”

Fact:

You own the home until a sale is completed and recorded. Afterward, timelines vary; some buyers offer relocation assistance (HUD).

5) 10-Day Action Playbook (Simple, Powerful)

- Open & date every letter; photograph envelopes/certified slips.

- Call the servicer (number from a statement) and request a reinstatement quote and last day to reinstate.

- Start loss-mit and upload a complete packet once (faster review).

- Confirm sale date with trustee/county site; add calendar alerts (−21/−14/−7/−3/−1 days).

- Choose a path: keep (mod/plan) vs. sell (MLS vs. cash).

- Get a cash offer with proof of funds & postponement experience: Get Offer.

- Verify wires by phone using a known number; avoid email changes.

- Centralize docs in one folder; keep a timeline log.

- Ask about relocation assistance if exiting.

- Stay cautious (see Safety section) and keep talking to your servicer.

Explainer (1:49): How a Cash Sale Works in Pre-Foreclosure

6) Datasets That Matter (Rates, Prices, Jobs)

Use public data to decide quickly and realistically in 2026:

| Dataset | Why It Matters | Link & License |

|---|---|---|

| Freddie Mac PMMS (via FRED) | Rates steer payment affordability & buyer demand. | FRED PMMS • Public/attributed |

| FHFA House Price Index | State/metro price direction informs list vs. cash decision. | FHFA HPI • Public domain |

| U.S. Census ACS (Migration) | Inflow/outflow shows demand pressure near you. | ACS • Public domain |

| BLS Jobs & CPI | Jobs and inflation shape payment stress & timelines. | BLS • Public domain |

| HUD Counselors | Free help preparing loss-mit applications and plans. | Find a Counselor • Public resource |

7) Safety: Wires, Scams & “Rescue” Pitches

Wire Safety

- Get wiring instructions via secure portal—never attachment alone.

- Call a known number (bank site/title site) to verify.

- Send a small test wire for large transfers.

Rescue Scams

- No upfront “rescue” fees; illegal in many states.

- Don’t deed your house to “helpers.”

- Keep talking to your servicer; real solutions align with them.

8) Case Studies (Fast Paths That Worked)

1) Reinstatement + Repayment

Within the breach window, a family borrowed to reinstate and set a 6-month plan for fees. No auction, no move.

2) Short Sale Approval

Underwater seller documented hardship; servicer paused sale and approved a short payoff. Closed in 45 days.

3) Cash Sale + Postponement

12 days to auction. We submitted a signed contract and proof of funds. Sale postponed; closed in 12 business days.

Related Guides & Local Pages

FAQs

Do I have to move out before the sale?

No. You remain the owner until the sale is completed and recorded. After a sale, timelines vary; some buyers offer relocation assistance (HUD).

Can I sell after a Notice of Default?

Yes. Many owners sell during pre-foreclosure. A signed contract can help a trustee postpone while you close (CFPB).

House needs repairs—what now?

Cash buyers purchase as-is. No showings required; we coordinate with trustee and title (Get Offer).

Is a short sale better than foreclosure for credit?

Typically less damaging than a completed foreclosure, but still serious. Ask your servicer how it reports to bureaus.

Can bankruptcy stop the sale?

Sometimes. It’s a legal tool with significant consequences—consult a qualified attorney in your state.

Want clear options by Friday?

We’ll review your letters, pull title fast, and give a plan—keep or sell. If selling fits, we buy cash in 7–21 days, no repairs.

Get My Cash Offer